LEDs, VCSELs, and cameras are converting automotive lighting from a problematic necessity to a value-added feature contributing safety, comfort, and style to the driving experience.

HANK HOGAN, CONTRIBUTING EDITOR

Studies cited by the Independent Institute for Highway Safety (IIHS) show that using automatic switching on old-fashioned high beams whenever possible reduces nighttime automotive crashes with animals, pedestrians, and unlit bicycles or cars by 26%. With the advent of inexpensive and rugged visible-range LEDs and other photonic technologies, automobile lighting is rapidly improving both inside and outside the vehicle.

The need for automobiles to illuminate the road runs counter to minimizing glare for other motorists. With the development of headlamps comprising cameras and individually addressable pixels, systems can now actively spare other motorists while still illuminating the road at night. Courtesy of General Motors.

Matrix lighting, for example, makes it possible for drivers to see twice as far at night without blinding oncoming traffic. Exterior projection lighting, which employs the same matrix technology, can inform other motorists of a driver’s intentions.

Lighting is also undergoing changes on the automotive interior. European Union regulations will mandate in-cabin monitoring of drivers and passengers for every new car sold starting in 2026. Near-infrared-emitting LEDs will play a key role in providing invisible-to-the-eye illumination for the cameras used in these systems.

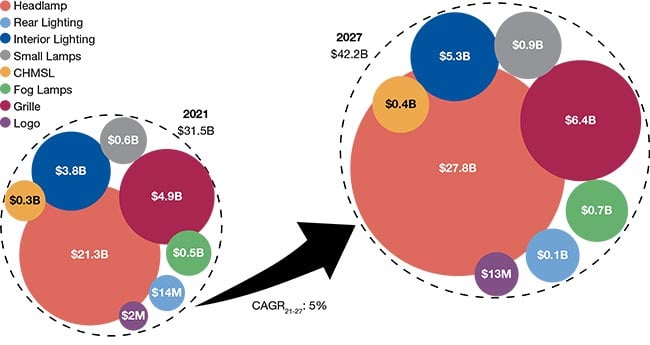

An automotive lighting market forecast breakdown by application and technology. Overall, the market for automotive lighting will see a 5% compound annual growth rate (CAGR) through 2027, with LED lighting enabling new value-added applications. CHMSL: center high mounted stop lamps. Courtesy of Yole Intelligence.

“With such a light source [LEDs],

automotive lighting has evolved from a basic function to a distinctive feature

with high-value potential,” said Pierrick Boulay, senior technology and market analyst in the photonics and sensing

division of Yole Intelligence, part of the Yole Group.

He added that high-value potential will help drive the global automotive lighting

market from $34.2 billion in 2022 to $42.2 billion in 2027.

The road ahead

System-level illumination designs are also adding value to the mix. One significant development is the expanding adoption of adaptive driving beam (ADB) technology, which has been available in Europe for years. Last year, U.S. regulators paved the way for the technology to find use in U.S. vehicles.

ADB systems incorporate forward-facing cameras and other sensors. The combination can detect the driver’s steering angle to actively swivel headlamps in the direction that the car is heading or adjust illumination to achieve the same effect through the use of a matrix of sources. Field research by the IIHS found that the technology allows headlamps to provide high-beam illumination to a driver while oncoming traffic sees a glare comparable to low-beam lighting.

Further, this capability can illuminate objects on the road at a distance that is more than double that of low-beam lighting. According to the IIHS, for instance, the driver of a 2023 Subaru Solterra should be able to see an obstacle in the left lane at 533 ft using high beams but only 202 ft ahead using low beams. Deploying ADB systems to extend the view substantially enhances a driver’s reaction time, because it takes ~300 ft for a car traveling at 60 miles per hour to come to a full stop, according to Consumer Reports testing.

The demand for better illumination of the road has historically run counter to the need to reduce glare, according to Kevin Quinn, product engineering director of bumper, fascia, grille, and trim at General Motors. Carmakers had to meet regulatory minimum requirements for illumination distance and lighting color without exceeding maximum limits. The result, Quinn said, was a win-lose situation in which improving illumination for one driver resulted in more glare for all other motorists.

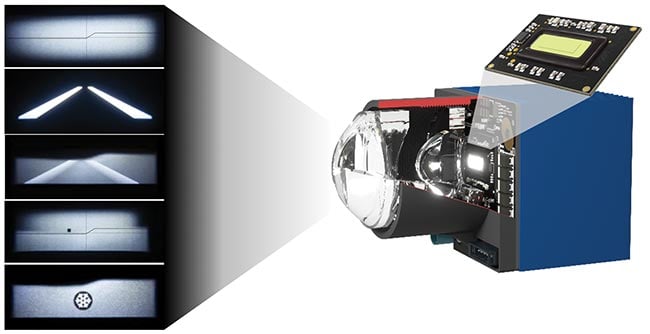

The development of individually addressable pixels in the headlight helped to rewrite this zero-sum game, which introduced benefits beyond ADB, according to Sylvia Weise, product marketing manager for Automotive Forward Lighting at ams OSRAM. So-called advanced adaptive beam systems emit light from headlamps comprising of a matrix of actively adjustable LEDs. Selectively switching these LEDs on and off can create a shadow in the illumination cone that illuminates the road while keeping oncoming motorists in the headlamp’s low-beam area.

“New ADB technology enables us to satisfy both the market demand for improved visibility and the market demand for reduced glare,” Quinn said. “We now have a ‘win-win’ situation for all.”

Boulay noted that LED manufacturers, such as ams OSRAM, Lumileds, Nichia, Samsung, and others, are developing adaptive lighting modules with resolutions between 20,000 and 30,000 pixels and an emission area of 40 sq mm. Modules incorporate an LED driver, and two can fit into one headlamp. Combining lighting modules with microlens technology results in a module that also saves installation space compared to what would be needed with larger and bulkier optics.

ADB systems also employ machine vision cameras to scan the environment. Image processing software informs a controller in the car that also helps to selectively adjust the beam to maximize visibility while minimizing glare. These systems can also integrate other safety signals, such as turn signals or brake lights. LEDs further enable new ways to project driver intentions onto the roadway, such as emitting a moving wave pattern of light, which indicates the direction planned for an upcoming turn.

Such features require headlamp designs to incorporate a substantial number of lines in the LED array, Weise said.

But in an industry in which “more” can be equated with “over-engineered,” LED arrays incorporating tens of thousands of addressable pixels can offer OEMs flexibility since the same module can be employed for ADB, projection, and other applications. Carmakers may also be able to satisfy different regulatory requirements around the world using the same module, which is an important consideration in terms of minimizing the number of different part types needed for vehicle manufacturing and repair.

MicroLED digital headlights underlie the high-definition adaptive driving beam systems on the road today. Using microLEDs and microlenses, manufacturers can pack more sources into modules to further enhance the definition of the beam. Courtesy of Lumileds.

LEDs have a market penetration >60% in headlamps and >80% in signaling, which suggests that the technology is in a late majority adoption phase, said Dirk Vanderhaeghen, senior director of strategic marketing at Lumileds. Differentiation, therefore, requires innovation beyond the LED itself.

“I want the light where I need it and that changes with the situation,” Vanderhaeghen said while discussing ideal outcomes of the combined technology. He added that having tens of thousands of pixels in a headlamp enables it to be extremely selective in terms of what gets illuminated and what does not. When combined with high-resolution cameras and powerful processors in the car, the latest ADB technology enables fine granulation. According to Vanderhaeghen, the system can restrict the low illumination area to the windshield of an oncoming car. Everything else could be flooded with light.

Notably, automotive-embedded cameras must now also figure into the equation. Since they play a prominent role in onboard sensing in vehicles, the impact of glare on cameras will become an increasingly important consideration.

In-cabin lighting

Visible LEDs are the most widely used light source for exterior illumination, according to Yole’s Boulay. For in-cabin monitoring systems that ensure drivers are alert, manufacturers instead offer LEDs emitting at wavelengths of 850 or 940 nm. Though nonvisible to the human eye, these wavelengths can be detected with CMOS sensors to offer an inexpensive source-sensor combination.

VCSELs, which can operate in the same spectral range, are offering a potential alternative, though the comparatively low cost of LEDs continues to give them the dominant position for in-cabin monitoring today. This may change in the coming years, however, if VCSEL prices drop, Boulay said. Some suppliers, such as ams OSRAM, are already incorporating these sources into in-cabin illumination modules.

VCSELs provide arguably better performance than LEDs. One reason is that in-cabin monitoring must contend with sunlight. Systems eliminate this ambient noise by applying a bandpass filter over the sensor that blocks out everything but the desired near-infrared illumination.

LEDs, however, have an emission width measured in the tens of nanometers while a VCSEL has an emission width of only 2 nm, said Clemens Hofmann, ams OSRAM senior principal engineer. Also, VCSEL temperature shift is 0.07 nm per degree centigrade versus the temperature

shift for LEDs, which is 0.3 nm per degree centigrade. Additionally, automotive electronics are required to operate over a temperature range of −40 °C to 125 °C, which means that LED emissions could shift 50 nm across the low to high temperature extremes.

LED matrix illumination projects a driver’s intentions and other information as visible signals directly onto the roadway. Courtesy of Lumileds.

Infrared lighting and camera sensors enable in-cabin monitoring systems to nonintrusively ensure a driver is alert and paying attention to the road. Courtesy of ams OSRAM.

Due to their narrower emissions and lower temperature shift, VCSELs allow the use of tighter bandpasses than LEDs. They also have a less visible red glow and better light distribution.

Vanderhaeghen noted that automotive

lighting, external or otherwise, has traditionally been regarded as a safety feature, with technology used to illuminate objects on the road and to make the car more visible to others. The advent of LEDs, cameras, computers, and software, however, is changing what lighting can deliver and is thereby shaping it into a more value-added feature in the vehicle.

As Vanderhaeghen put it, "See and be seen in migrating more toward sense and communicate."