The Russian military invasion

of Ukraine on Feb. 24 activated a global narrative that could unfold over months and even years. While the eventual scale and outcome of the war remain open questions, the potential implications of the conflict are already rippling through global markets and supply chains, and many stakeholders in the photonics industry are scrambling to understand their exposure to a shifting risk landscape.

Ukraine, for example, is among the leading global suppliers of the semiconductor-grade neon gas that powers the high-intensity excimer lasers used in the fabrication of integrated chips — a sector that was already struggling for capacity

before Russia invaded its neighbor. Ukraine’s top companies responsible for the purification of the gas have shuttered their operations.

Fiber laser-maker IPG Photonics responded quickly in the wake of the invasion of Ukraine to increase its manufacturing capacity and inventories of critical components in Germany and the U.S. The company also aimed to qualify third-party suppliers of components to reduce reliance on its Russian operations. By late March, the company reported that it had already made progress on these plans. Courtesy of IPG Photonics.

Meanwhile, leading optics and photonics companies have halted or ended business in Russia. German specialty glassmaker SCHOTT shuttered a multimillion-dollar investment into a project to produce pharmaceutical vials in Russia. EKSPLA, a Lithuanian manufacturer of solid-state lasers, stopped all business relations and partnerships with Russia and Belarus. Intel suspended all shipments to customers in both countries as well. Other companies, such as U.S.-based fiber laser developer IPG Photonics, are more deeply invested in Russia and reliant on resources and components from manufacturing operations there.

The potential for international sanctions is further complicating the routine flow of business and government initiatives aimed at fueling growth in photonics markets. China has so far adopted a detached and neutral position on the war to avoid sanctions from either side. But that position will become increasingly difficult to maintain in an extended conflict, and any blowback on China’s nearly $13 billion laser market would be particularly consequential to global commerce in the long term. Chinese trade volume with Russia is roughly 10% of its volume with Europe.

At this stage of the conflict, all scenarios for its impact on photonics and laser markets are speculative. It is possible, however, to explore how emerging risks are distributed across today’s shifting global supply chains and markets.

Disruption to the neon supply

The world’s neon gas supply doesn’t often figure into headlines. But this supply is essential to the semiconductor industry’s capacity to produce integrated chips — a capacity that was flagging even before Russia invaded Ukraine.

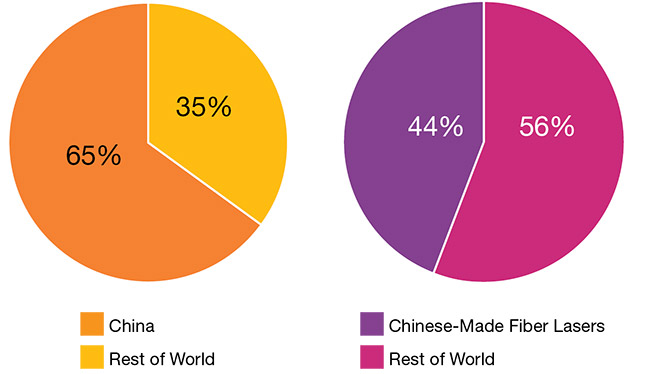

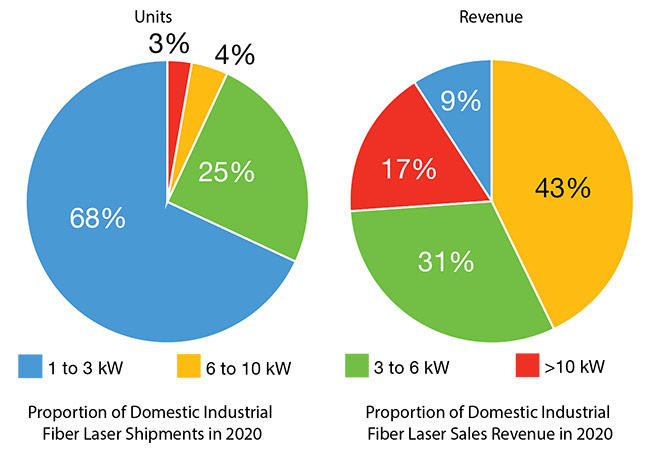

In 2021, the Chinese fiber laser market reached $1.8 billion, which accounted for 65% of the $2.7 billion global fiber laser market (left).

Chinese domestic fiber laser revenues reached $1.2 billion, accounting for 44% of the global fiber laser revenue (right). Courtesy of BOS Photonics.

Two lasers — the 193-nm argon fluoride (ArF) excimer and the 248-nm krypton fluoride (KrF) excimer — power the deep-ultraviolet (DUV) lithographic processes used to manufacture semiconductor chips. Mixtures of both noble and halogen gases combine to create the

pulsed gas discharge that produces excited molecules with a nonbinding electronic ground state. The gaseous mixtures used in ArF, KrF, and other excimers are critical to the chemical reaction that enables the emission of DUV photons. Neon, however, makes up most of the necessary gas mixture — about 95% — in some excimer systems.

“Around 90% of all neon goes into excimer lasers,” said Richard Betzendahl, a gas and chemical expert and owner of Betzendahl Gas Consultants. “And of the excimer laser market, nearly 90% is electronic chip manufacturing.”

Under normal circumstances, he said, Russia and Ukraine together account for about 30% of the global neon supply. Other projections based on values from market research firm TECHCET place this figure between 40% and 50%. Market research firm TrendForce reported before the start of the war that Ukraine alone supplied nearly 70% of the world’s neon gas capacity.

“It’s quite difficult to track down where all the sources are because some materials are shipped direct, and some are shipped through distributors and other entities,” said Ralph Butler, senior director of business development at TECHCET. However, he estimated that semiconductor manufacturing consumes 90% of the global supply of high-purity neon. And he said that as much as 90% of the high-purity neon that the U.S. semiconductor industry imports comes from Ukraine.

China’s development of ultrafast, UV, and direct-diode lasers is further driving its domestic growth and shrinking its reliance on imports.

While Russia and Ukraine hold different roles in the neon gas supply chain, the war has affected the ability of both to carry out normal functions. Russia is one of the world’s largest producers of steel, which is consequential because neon is a byproduct of steel production. Exporters in Ukraine further refine the gas that they export for use in integrated chip production and other industries.

Major companies responsible for the purification of Eastern European product are located in Odesa and Mariupol, Ukraine, and these plants are currently shut down, as are domestic steel mills in the country. Despite ongoing steelmaking in Russia, its high-purity, semiconductor-grade neon is not currently leaving Eastern Europe through the usual Ukrainian channels.

Excimer implications

Events that long preceded the war had already been reshaping global supply chains for neon gas, and these events provide some context for how a new shortage might shake out. Fifteen years ago, Eastern Europe managed closer to 70% of the world’s neon supply. While neon production started to shift from one primary production region to several, demand for neon gas also started to diminish — until around 2014, when the excimer laser process for semiconductor chip manufacturing began using significant amounts of the gas, Betzendahl said. The rising consumption of neon while production declined caused a significant shortage at the time. To minimize shortfalls, semiconductor laser-makers and chipmakers worked to reduce the amount of neon gas needed to operate their equipment without sacrificing performance. “They reduced the demand at the plants by almost 30%,” he said. “At the same time, we added about 20% to global production. Due to the shortage in demand, this caused a surplus of neon.”

Later, after neon prices climbed by more than 500% in 2014, companies took steps to diversify their suppliers. China — which, according to Betzendahl, now supplies about 40% of the world’s neon — enhanced its export capacity to meet demand. So did the U.S., though to a lesser extent.

Today, the large number of links in the neon gas supply chain means that it could take months for significant impacts from the war to manifest in semiconductor production. After crude gas is produced during steelmaking, it is sent for batch purification, then shipped to another facility where the neon-fluorine laser mixture is created. In some cases, an intermediary is enlisted to sell the product to chipmakers.

“Because of that, the number of hands it is going through, you have a good three, four months — maybe even more — of product flowing through the system before the real shortage is going to take effect,” Betzendahl said.

Gaps in supply could also emerge unevenly for semiconductor fabricators because larger players are better positioned to source and store requisite quantities of neon gas.

Another factor determining neon’s availability is a buyer’s ability to leverage its own relative size or position within a higher-demand end market for chips.

“The large companies with more significant buying power will take precedence over smaller companies,” Butler said.

Photolithography systems developer and manufacturer ASML told Photonics Media that it currently uses very little neon in its manufacturing, and that less than 20% of the neon it does use comes from Russia and Ukraine. The company called the potential supply chain disruption stemming from the war a “nonissue.”

Supply chains for the gases krypton and xenon are being affected similarly to that of neon. “The prices for krypton and xenon started increasing about a year ago,” Betzendahl said.

“We were starting to see a short supply anyway,” Butler said. And because the steelmaking process also yields these gases, he said, any disruption in the crude that influences neon gas production can have a similar effect on other materials.

Difficult decisions for IPG

While corporations from multiple countries and industries severed ties with Russia and Belarus following the invasion of Ukraine, IPG Photonics announced in March that it would continue its operations in Russia. Russia and Belarus are each home to one of IPG’s four major manufacturing facilities.

IPG is synonymous with fiber laser research and development in Russia, and the country supplies components for IPG’s other major facilities in Germany and the U.S. IPG’s primary Russian complex, near Moscow, is also used to ship components to affiliates.

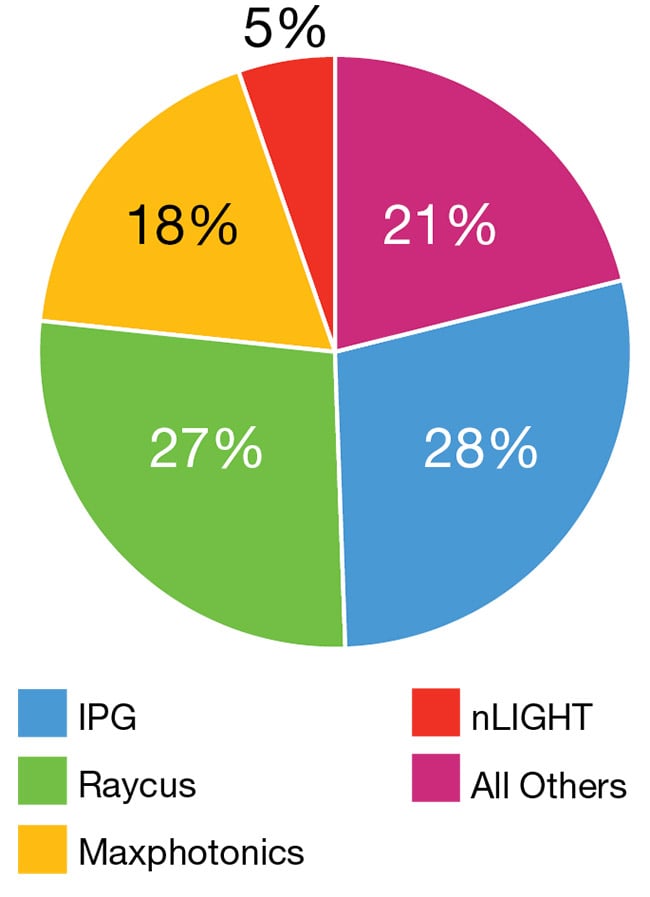

IPG Photonics, Raycus, Maxphotonics, and nLIGHT — the top four fiber laser companies in China, as measured by sales — represented about 78.7% of all fiber laser sales in that

country in 2021. Courtesy of BOS Photonics.

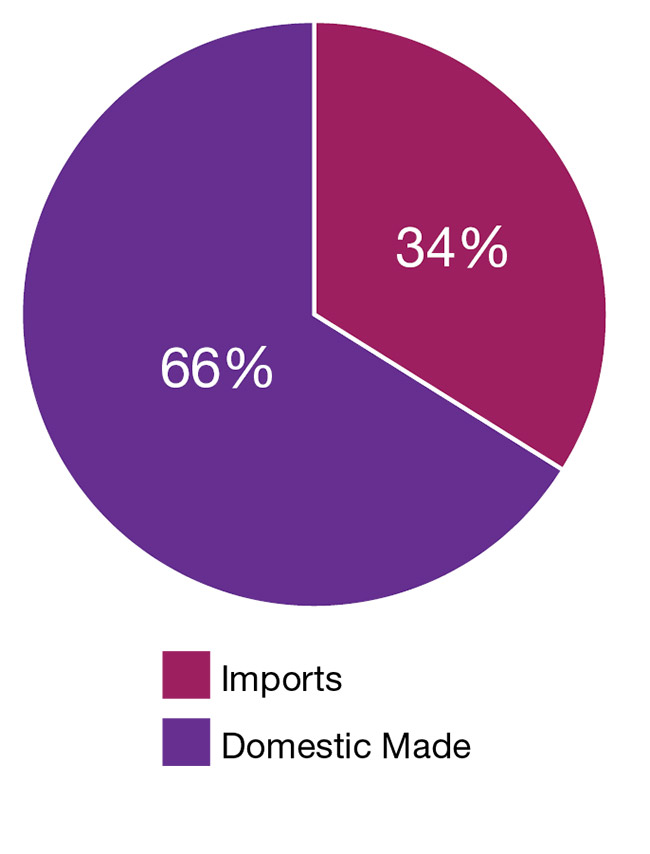

Of China’s $1.8 billion market for fiber lasers, domestic suppliers — including Raycus and Maxphotonics — accounted for about 66% of all sales in 2021. Courtesy of BOS Photonics.

The ability to manufacture components at low cost in Russia is an advantage for IPG, said Mark Miller, an analyst who covers the company, as well as the hardware technology industry, for The Benchmark Company.

However, in a March 3 press release,

IPG said it planned to increase its manufacturing capacity and inventories of critical components in Germany and the U.S. and qualify third-party suppliers of components to reduce reliance on its

Russian operations. In a subsequent

statement dated March 29, IPG said it

had made progress toward shifting

manufacturing capacity from Russia to facilities in Western Europe and the

U.S.

These contingency plans were devised due to the possibility that international sanctions prompted by the invasion of Ukraine could affect the company. While IPG is an American company, with a majority of its operations and assets in the U.S. and Western Europe, it has facilities in Russia and Belarus. It therefore faces exposure to sanctions imposed by either side of the conflict. According to the

company, sanctions will increase lead times and shipping costs for components and lasers to and from its Russian operations. If sanctions or other developments from the war substantially limit IPG’s ability to export components to or from Russia, the company’s sales may be

materially affected.

IPG said it believes it can reduce the risk related to sourcing components

from Russia in as little as six months. “They can probably make the transition,”

Miller said. He added that IPG has also built up significant inventories of these components in Russia. These inventories span several months’ worth of operations.

In its March 29 statement, IPG said

it had curtailed development projects

and had shut down some existing projects.

Whether sanctions hit IPG or not, the company faces challenges beyond the logistical hurdle of rerouting production and component sources. “If they manufacture outside of Russia, it is going to be higher costs for them,” Miller said.

These costs would have consequences over time.

Though significant, the risks arising from the company’s connections to Eastern Europe are not crippling. IPG’s sales to Russian customers have traditionally been nominal, representing $30 million, or about 2% of the company’s total revenue of around $1.5 billion. IPG’s current cash balance in Russia is less than 1% of its total current cash, and the Russian operations are self-funding.

Impact on China likely delayed

Though China has taken a carefully

neutral position on the Russia-Ukraine war, its massive laser and photonics

market threads through many of the global supply chains, end markets, and photonics companies directly affected by the war.

While sanctions and trade relationships could change revenue streams for many companies doing business in and with China, there have been few if any direct or immediate consequences from the war on China’s laser and photonics market, said Bo Gu, president and CTO of U.S.-based consultancy firm BOS Photonics. The Chinese fiber laser market reached $1.8 billion in 2021 at an annual growth rate of more than 21%.

Since 2020, shipments of domestic Chinese high-power fiber lasers (left) outside the 3-kW power range have increased significantly, with most market activity (60%) now concentrated in the 6- to 10-kW range.

As China introduces more domestic 20- to 40-kW fiber lasers in coming years, additional revenue is expected from the 10- to 40-kW range — especially as sheet metal processing applications drive broader adoption of 12- and 20-kW lasers (right). Courtesy of BOS Photonics.

“In terms of this conflict’s impact on the Chinese photonics and laser industries, it is quite limited,” Gu said. “The reason is simple. China doesn’t do much importing or exporting with Ukraine.”

Moreover, the ascent of China’s domestic photonics industry has allowed the country to foster self-reliance insofar as it relates to its photonics ecosystem.

The rapid increase in China’s domestic production of lasers — and specifically fiber lasers — has significantly diminished China’s exposure to fluctuations in laser system imports. Research by BOS Photonics indicates, for example, that half of the 6-kW and higher fiber laser systems in China were imported in 2021, compared to about 90% in 2018.

China’s development of ultrafast, UV, and direct-diode lasers is further driving its domestic growth and shrinking its reliance on imports. Domestic suppliers have recently emerged for photonic commodities, including laser chips, isolators and collimators, beam combiners and couplers, and fiber gratings, BOS Photonics reported.

If the war has any impact on China’s photonics agenda, according to Gu it will most likely involve an interruption to the country’s designs on an expanded role in the leadership of global infrastructure development. Russia and Ukraine are key parts of China’s Belt and Road Initiative, also known as the One Belt One Road Initiative, Gu said.

“China wants to go through these countries, and Central Asia as well, to have a connection with Europe which goes all the way to London and Germany,” he said. “Right now, that has been definitely damaged, if it’s not completely eliminated.”

The aim of China’s Belt and Road Initiative is to establish trade networks and increase regional connectivity, creating an infrastructure that would encourage businesses to make and develop products using lasers and laser systems.

“Along this trading road, there are a

lot of things to be exported and to be built,” Gu said. “And that, in the long

run, will impact China’s exports, including of electromechanical products —

cellphones and computers — which all use lasers.”

Lasers are also needed for the cutting, welding, and drilling processes used to build infrastructure components such as high-speed trains, railroads, and bridges. If the goals of the initiative fail to manifest, the Chinese laser market could take a hit, Gu said. “That impact is not going to be immediate,” he said. “But I think in the long run we may see some fallout of this conflict on the Chinese economy, eventually down to the laser industry.”