Some in the industry say they see fiber continuing to make large gains in the manufacturing space, but others say don’t count thin-disk out.

The boom in fiber lasers that began several

years ago has led some to question whether there is still room in the industrial

manufacturing space for both the glamorous new star and its slightly less hip cousin,

the disk laser. A short survey of companies on both sides – and neither side

– of the issue reveals that the answer is yes, but that the choice is not

limited to just one or the other.

To understand where these lasers are heading in manufacturing,

we first have to look at where they’ve been.

The skinny on fiber

Fiber lasers are much older than disk lasers, having been conceptualized

just months after the first laser – the ruby – was demonstrated by Ted

Maiman in 1960. Working for American Optical, Elias Snitzer theorized the fiber

laser in 1961 and demonstrated the first lanthanide-doped glass fiber laser in 1963.

But that flashlamp-pumped laser had an extremely low output power, a condition that

was to plague lasers for decades.

In fiber lasers, a rare-earth element such as erbium or ytterbium

is doped into the core of an optical fiber. Laser emission is created within the

fibers using a semiconductor diode as the light source and delivered through a flexible

optical fiber cable. Fiber lasers have a monolithic, entirely solid-state design

that does not require mirrors or optics.

Two important, interrelated developments have helped move fiber

lasers from lab curiosity to serious commercial contender in the past decade: The

creation of high-power laser diodes that boost the lasers’ pump power enough

to compete with other lasers, particularly less efficient lamp-pumped systems, and

market advancements that have made those diodes more affordable and reliable.

Key advantages of fiber lasers include high (near-diffraction-limited)

beam quality, high power generation, high reliability, low jitter and amplitude

noise, turnkey operation and small size.

As fiber lasers have continued to grow in output power, they have

increasingly become used in materials processing applications such as marking, printing,

welding and cutting, as well as for micromachining, drilling, soldering and annealing,

among others.

With laser outputs of up to 16 kW and beam qualities

starting at 2 mm x mrad, disk lasers offer unrivaled robustness – for highly

productive thin sheet cutting as well as for welding. Courtesy of Trumpf Group.

The company most credited with making fiber lasers commercially

viable is Oxford, Mass.-based IPG Photonics, founded in 1990. IPG has aggressively

and successfully been replacing older, less efficient lasers with fiber alternatives

for high-power industrial applications. In December 2009, the company introduced

four quasi-CW (continuous wave) fiber lasers with peak pulse powers of 750, 1500,

3000 and 5000 W designed to replace the older flashlamp-pumped, long-pulse YAG lasers

that then had a large share of the world laser market. IPG’s lasers offered

efficiency rates of 30 percent compared with 3 percent for flashlamp-pumped lasers.

“We’re replacing an awful lot of old lasers, but disk

is trying to do the same thing,” said Bill Shiner, IPG’s vice president

of industrial markets.

New kid on the block

Thin-disk lasers are diode-pumped, solid-state lasers first demonstrated

in 1993 by Adolf Giesen and his group at the University of Stuttgart in Germany.

The gain medium is a laser crystal, typically Yb:YAG, formed not as a rod but as

a very thin disk, making the design less susceptible to distortion and other adverse

effects as compared with many other laser types. Nd:YAG is also used but has a shorter

emission wavelength. Other ytterbium-doped gain media are used for broad wavelength

tuning. The thickness of the disk is usually much smaller than the laser beam’s

diameter.

In addition to its ability to be cooled very efficiently, the

main advantages of thin-disk lasers are that their power and pulse energy can be

scaled to much higher values than rods, fibers or slabs. It’s easy to scale

power with a thin-disk laser: You simply have to increase the diameter of the pump

area of the disk, but the trade-off is decreasing beam quality.

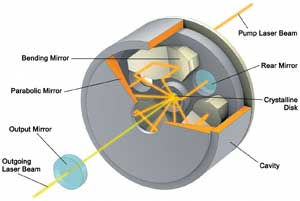

Transforming a low-quality pump laser beam into a high-quality beam:

a glimpse inside a disk laser. Courtesy of Trumpf Group.

Thin-disk lasers can generate ultrashort pulses at very high power

levels, making them attractive for industrial applications. They can also generate

high-energy nanosecond pulses with high beam quality, which is also attractive

for some laser materials processing applications. Combining disks makes it possible

for the lasers to achieve nearly any power level desired.

Continuing improvements to disk lasers are focused on increasing

power and beam quality. “The target is getting more power out of one disk,”

said Dr. Kurt Mann, director of international sales at Trumpf, a major manufacturer

of disk lasers. “We now have 6 kW of power available in one disk.”

As recently as 2005, it took four separate disks to achieve an

output of 4 kW, so improvements Trumpf has made to its thin-disk technology are

also helping to make the lasers more affordable.

Team of rivals

The rivalry between fiber and disk lasers has been brewing for

several years, as fiber lasers grow in power and efficiency, decrease in cost and

move into manufacturing areas dominated by disk lasers, such as welding and cutting.

Both types of lasers had marked advantages over, say, gas and crystal lasers in

terms of scaling power not by increasing the gain medium but by increasing the power

per volume.

Fiber lasers provide precise, fine welding and fast cutting, but

disk lasers with their ease of power scalability can offer manufacturers flexibility.

Most manufacturers seem to agree that the laser you choose is ultimately application-driven.

In the CW regime, arc-lamp-pumped lasers have been completely

replaced with diode-pumped, Mann said, but even lamp-pumped lasers continue to have

financial advantages for manufacturers.

At a Market Focus session on industrial lasers during CLEO (the

Conference on Lasers and Electro-Optics) in May 2010, a brave soul posed the question,

“What’s better, thin-disk or fiber lasers?” A year later, the

answer you get is pretty much the same, but it depends on who is doing the answering.

“If I look at fiber lasers, our price keeps going down and

down. We’re the least expensive multikilowatt laser on the market,”

Shiner said. “Automotive has completely gone to us worldwide.”

“Both lasers have advantages in industrial applications,”

Mann said. “Fiber has excellent beam quality. When you have high-power applications

and don’t have high requirements on beam quality, then you go with the disk

laser.” Tasks such as car body welding and soldering, for example, don’t

require the high beam quality of a fiber laser.

“There is not one single laser which will cover all regimes,”

said Dr. Hans-Dieter Hoffmann of Fraunhofer Institute for Laser Technology (Fraunhofer

ILT) in Aachen, Germany, adding that the bottom line with manufacturers will always

be “what is the most cost-efficient source to do the process.”

“The electro-optical efficiency of both lasers is very comparable,

about 30 to 35 percent,” Hoffmann said. “The real domain of fiber is

in CW from zero to one kilowatt.”

At Laser World of Photonics 2011 in Munich, Germany, Coherent

– a major maker of CO2 (carbon dioxide) and diode lasers – included

in its floor models its first fiber laser, the 1-kW Highlight 1000FL, which is scheduled

to officially launch this fall.

“We started with technology and ideas and then looked into

the market and found out what the market wants,” said Fred Kallweit, head

of medical laser sales for Jenoptik Laser GmbH’s Lasers and Material Processing

Div. Jenoptik, of Jena, Germany, sells both thin-disk and fiber lasers. While many

of its customers are interested in fiber, “We think the market is there also

for thin disk,” he said.

Blurring the line between the two laser types is the fiber-guided

disk laser; the TruFiber system by Trumpf is one example.

The five-axis Trulaser Cell 3010 is typically used for welding and

cutting sample parts and prototypes. Courtesy of Trumpf Group.

Trumpf announced at Laser Munich 2011 that it had received an

order worth €37.5 million from Volkswagen AG, mostly for 50 of its TruLaser

Cell 8030 fiber-guided disk laser machines, to be delivered over the next two years.

Volkswagen will use the machines in high-volume production of hot-formed parts

for car bodies.

Also at the event, Trumpf displayed its new 2 in 1 fiber developed

for its TruDisk disk lasers, which allows users to switch applications without changing

the laser light cable. The cable has an inner-diameter fiber core of 100 µm for

cutting and an outer ring with a 400-μm-diameter fiber for welding. The cable

is a standard feature on the company’s TruLaser Cell 3010 machine for 2- and

3-D laser processing.

3-D laser processing with the TruLaser Cell 7040. Courtesy of Trumpf Group.

No KO to CO2

A carbon dioxide laser electrically stimulates a gas-filled tube

(a mix of helium, nitrogen and carbon dioxide) to produce light. It currently has

no rivals in the industrial market for flatbed cutting of materials thicker than

4 mm, and the laser has replaced conventional methods such as punching or milling

for materials with thicknesses up to 25 mm. It is also the most popular choice for

welding thick plates.

Low-power CO2 lasers are cost-efficient for marking, engraving

and cutting applications where long wavelength is a plus. Although solid-state lasers

have been making inroads, gas lasers continue to hold on to about half of the materials

processing market share.

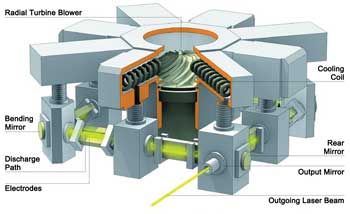

Compact, powerful and reliable: a glimpse inside a flowing gas CO2 laser with square design. Courtesy of Trumpf Group.

Because the laser radiates in the far-infrared at 10.6 μm

and most materials absorb at that wavelength, there is interest in using CO2 lasers

to cut materials besides metal.

“CO2 lasers have a benefit in that they are a proven technology,”

Hoffmann said. “Because CO2 is 10 μm, you can do plastic cutting with

it. Glass is black for CO2 emission and also at the component level [the lasers

are used to drill holes in printed circuit boards],” Hoffmann said.

Both fiber and disk lasers emit at the 1-μm wavelength and

currently can’t compete with the cut quality of CO2 lasers when it comes

to thick materials, although the difference that wavelength makes in materials processing

isn’t fully understood.

“We’re doing fundamental analysis on why 1-μm

cutting is different from 10-μm cutting, regardless of the type of laser,”

Hoffmann said. For example, 10-μm lasers are twice as fast at cutting into

components as 1-μm lasers.

“There are interesting applications for CO2; I don’t

think CO2 is at an end,” he said.

At Laser Munich, Coherent presented the Metabeam 1000 machining

tool, which includes a 1000-W, completely sealed CO2 laser that it said competes

favorably with fiber on a wide range of metals but can also process organic materials

such as wood and plastic. The company also plans to release a kilowatt fiber-based

Metabeam later this year.

An ultrafast future

As components and other devices continue to shrink in size, and

as new and exotic materials are introduced into manufacturing, opportunities continue

to open up for ultrafast laser applications in the life sciences, energy and advanced

materials fields. Femtosecond and picosecond pulse repetition rates allow for athermal

ablation – the removal of material without incurring heat that could induce

melting or form burrs or cracks in the material.

A 10-μm hole was machined into the side of this 120-μm glass needle used in life sciences applications. Courtesy of Raydiance.

“Fiber ultrafast lasers are starting to get introduced in

large application areas and will have a strong future,” Hoffmann said. “With

picosecond, five years back no one used them in manufacturing. Now they are used

in the production of semiconductor products.”

A company that led the development of picosecond lasers for industrial

microprocessing is Lumera Laser of Kaiserslautern, Germany.

While picosecond lasers have been moving into the industrial space

for several years, femtosecond lasers are just beginning to make their mark.

The new StarCut Tube Femto combines Rofin’s systems solution engineering with Raydiance’s femtosecond laser platform. This first rollout of Rofin systems with photons by Raydiance is designed for the cardiovascular stent manufacturing market. Courtesy

of Business Wire.

In his plenary talk at Laser Munich, Barry Schuler, CEO and co-founder

of Petaluma, Calif.-based Raydiance, said that femtosecond technology has challenges

to overcome, such as the fact that it’s inherently complex and unstable, expensive,

and eccentric in its setup and operation but that “it has a rich potential

across many applications,” such as photovoltaic and microelectronic components

manufacturing.

What is needed to ramp up commercialization, he said, is industrial-grade

reliability, manufacturing floor robustness, ease of integration, easy maintenance

and a small footprint, among other requirements. These are met in Raydiance’s

Smart Light, which it says is flexible and reliable enough to be used by researchers

with little or no background in optics and lasers.

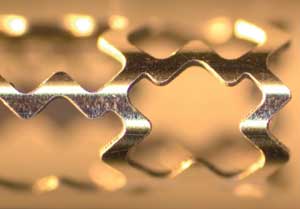

This Nitinol stent, machined with the StarCut Tube Femto, was cleaned

in an ultrasonic bath of isopropyl alcohol for 5 minutes, then photographed. Note

that there are no heat-affected zones. Courtesy of Business Wire.

“I think it’s going to cause a revolution, not only

in manufacturing but many other spaces,” Schuler said.

A year ago, Raydiance and Rofin-Sinar Technologies Inc., of Plymouth,

Mich., and Hamburg, Germany, announced that Raydiance’s fiber-based laser

approach would be incorporated into Rofin’s StarCut Tube Femto, which allows

“cold” laser cutting of medical devices such as cardiovascular stents.

The machine cuts noble metals that are difficult to machine, such as gold and platinum,

as well as alloys with shape memory and polymers with a low melting point, all with

no thermal effects.

A laser beam enables one to cut nearly any shape, regardless of its

complexity. Its strength lies in the ability to process the widest range of material

types and thicknesses, distortion-free. Even foil-coated sheets are

no match for a laser cutter. This flexibility is highly advantageous, especially

when paired with a variety of machine models. The edges are smooth, and the processed

parts are ready for assembly without requiring refinishing. Courtesy of Trumpf Group.

Thin-disk technology also has a femtosecond laser on the market.

Jenoptik Laser recently introduced its JenLas D2.fs, which the company said opens

up new industrial applications for diode-pumped disk lasers due to its 400-fs pulse

rate, M2 beam quality and high pulse energies of 40 μJ at a 100-kHz repetition

rate.

A booming market

The economic downturn in 2009 saw laser sales worldwide decline

by 25 percent, the first such decline since 2000. The good news now for laser manufacturers

is that market interest has been renewed in the past year in a big way, and for

all types of industrial lasers.

While the market began to rebound in the second half of 2010,

it still fell 16 percent short of 2008’s all-time peak level. But now sales

of laser systems for materials processing applications are on track to grow by at

least 10 percent this year, Arnold Mayer of Optech Consulting told attendees of

the 10th International Laser Marketplace at Laser Munich.

Gas lasers still account for half of the lasers used inside systems

for materials processing applications, Mayer said, but non-gas sources such as solid-state,

direct-diode and fiber are poised to take the lead this year.

The market forecast for laser materials processing systems is

growth of about 10 percent in 2011, according to Mayer. An informal survey of laser

makers at Laser Munich revealed high customer interest in CO2 lasers.

In its financials for the fourth quarter of 2010, IPG reported

a 106 percent year-over-year increase in materials processing sales, its largest

market. At press time, Trumpf was expected to post a 70 percent increase in laser

sales for the fiscal year ending in June.

“With a record backlog of approximately $349 million and

a solid business outlook, we are raising our fiscal 2011 revenue estimate to $790

[million] to $805 million, which corresponds to 31 to 33 percent annual growth,”

said John Ambroseo, CEO of Coherent, in announcing the second quarter of 2011 fiscal

report.

Rofin-Sinar’s revenue plunged in the third quarter 2009,

and it reported a net loss of $4.9 million. Also that year, the company laid off

10 percent of its employees. On May 5, 2011, the company reported second-quarter

revenue of $136 million, up year-over-year from $96 million, and it could set a

new revenue record of $580 million this year, said Rofin-Sinar officials. The company

also hired 70 workers during the quarter and announced recently that it had purchased

a complex in Tampere, Finland, for $5.3 million to increase its fiber laser manufacturing

capacity.