The microelectromechanical systems (MEMS) market is expected to surpass a staggering $11 billion by 2012, according to Yole Développement, a French market research and strategy consulting company specializing in the MEMS, compound semiconductor, nano- and life sciences fields.

In 2009, the market was valued at $7 billion. It rose to $8 billion in 2010, but the anticipated leap in value is expected to come primarily from the consumer and telecommunications markets, including cell phone and other handheld devices. Other growth drivers will come from the automotive, biology and health care markets.

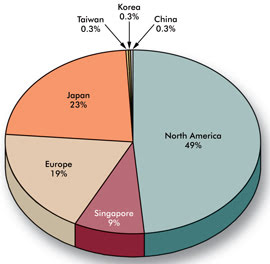

Although the US commands a large share of global revenue – 49 percent – and boasts the top two manufacturers – Texas Instruments and Hewlett Packard – Europe accounts for about 20 percent and is home to the third largest manufacturer, STMicro-electronics in Italy, whose headquarters are in Geneva. Europe also is a thriving hotbed of MEMS-based research, with some of the leading research and development institutes, including CEA-LETI (Atomic Energy and Alternative Energies Commission-Laboratory for Electronics & Information Technology) in France, IMEC (Interuniversity Microelectronics Centre) in Belgium and Fraunhofer in Germany.

At left, a miniature laboratory on a chip: STMicroelectronics’ In-Check platform allows users to accurately and reliably process and analyze minute patient samples – human blood, serum or respiratory swabs – on a single disposable thumbnail-size chip. This approach reduces the time, complexity and risk of cross-contamination inherent in conventional analysis methods. Courtesy of STMicroelectronics.

Consumer electronics on the go

MEMS technology has become widely popular in sensors for measuring motion, acceleration, inclination and vibration. Such properties are attracting much interest, particularly in the consumer and mobile markets, where MEMS accelerometers and gyroscopes are being used in various motion-activated devices.

The L3G4200DH is the latest addition to STMicroelectronics’ MEMS portfolio. The device comprises a three-axis digital-output gyroscope that embeds a FIFO (first in/first out) memory block that stores up to 96 levels, split into 32 sample sets of X-, Y- and Z-axis data. Courtesy of STMicroelectronics.

“The sensors can add an intuitive man-machine interface to a mobile phone, MP3/MP4 player, PDA [personal digital assistant] or game controller, creating interaction by linking the user’s wrist, arm and hand movements to applications, navigation within and between pages, the movement of characters in a game and much more,” said Fabio Pasolini, motion MEMS business unit director at STMicroelectronics.

STMicroelectronics’ MEMS gyroscopes employ a unique concept of a single sensing structure for motion measurement along the three orthogonal axes. This covers three main types of angular motion, including yaw (rotation around the vertical axis), roll (rotation around the front-to-back axis) and pitch (rotation around the side-to-side axis). The design eliminates interference between the axes for use in a wide range of consumer and industrial applications, including advanced user interfaces for gaming and portable devices, motion tracking and camera image stabilization.

Another typical MEMS application is data protection in portable devices. In case of a free fall or other abnormal movement, a MEMS accelerometer can be incorporated to instruct the system to stop all reading-and-writing hard-disk-drive operations and to park the magnetic head to a safe position. MEMS accelerometers also are commonly integrated as vibration detectors in today’s electronic home appliances, such as washing machines or dryers, to alert users to unbalanced loads and to protect against excessive wear of parts before a failure occurs.

“MEMS gyroscopes, or angular-motion sensors, complement acceleration sensors in man-machine interfaces, making gaming and remote-pointing more exciting,” Pasolini said. “These gyroscopes also counteract digital video or still camera shaking for sharper shots, and enhance car navigation applications for dead-reckoning and/or map-matching.”

Dead-reckoning systems back up a GPS signal when it can’t be seen, such as inside buildings and in urban areas, by monitoring motion, distance traveled and altitude, and by correcting digital-compass readings.

MEMS technology sounds good

Micromachined acoustic devices, or MEMS microphones, are raising the bar in sound quality, reliability and cost-effectiveness for existing and emerging audio applications, including cell phones, notebook computers, video recorders, digital cameras, hearing aids and electronic stethoscopes.

By integrating multiple MEMS microphones in arrays, additional features such as noise suppression and directional voice pickup become possible.

“Such features are valuable with the increasing use of wireless devices in noisy and uncontrollable environments and can sensibly improve the quality of mobile conversation and conferencing,” Pasolini said.

Lab on a chip becomes multifunctional

According to Dr. Eric Mounier, MEMS equipment and materials project manager and co-founder of Yole Développement, European R&D efforts are strongly driven by the biology and health care markets, with much effort focused on developing chips with integrated functions such as sample preparation, microfluidics and electronics.

Europe accounts for about 20 percent of global revenue in MEMS manufacturing, with North America in the top spot with 49 percent. Courtesy of Yole Développement.

“Device developments are labs on chips with integrated PCR [polymerase chain reaction], concentrators, micropumps, smart textiles and bioprobes for in vitro diagnostic and protein screening applications,” he said. “Technology breakthroughs include hybrid material integration such as silicon and plastic or silicon on glass as well as new processes such as plastic injection molding and surface functionalization.”

A good example of such lab-on-a-chip devices is STMicroelectronics’ In-Check. This platform makes use of silicon’s electrical and thermal properties to offer cost-effective analysis in a disposable tool.

“ST’s In-Check … is the first biochip that integrates amplification and microarray detection of DNA samples to enable a high degree of multiplexing with speed, accuracy and ease of use,” said Robert Hodges, business director for molecular diagnostics at STMicroelectronics. “The combination of these capabilities has already resulted in benefits for health care professionals in Asia and the Middle East during the swine flu pandemic. We will obtain regulatory approvals this year that will enable a broader range of health care professionals in the EU and US to take advantage of the technology.”

The miniature lab on a chip enables users to process and analyze minute patient samples such as human blood, serum or respiratory swabs on a single disposable thumbnail-size chip.

In 2008, STMicroelectronics teamed up with medical diagnostics company Veredus Laboratories of Singapore to develop VereFlu, a portable lab-on-a-chip application for rapid detection of all major types of influenza.

VereFlu can identify and differentiate human strains of Influenza A and B viruses, including the Avian Flu strain H5N1, in a single test. The hope is that the diagnostic chip will enable health care professionals to effectively monitor mutations of flu viruses and quickly identify the main strain of the season. This could help to increase the effectiveness of flu vaccinations and reduce health risks to the public associated with the emergence of a new virus.

Managing the future

Analysis by Yole Développement reveals that the MEMS production infrastructure is undergoing two key changes, one of which includes the transition from 6- to 8-in. wafer size driven mainly by consumer applications. The other is the strong growth in the MEMS foundry markets, driven by development of the fabless companies and the start of production outsourcing by major MEMS manufacturers.

“With no clear idea of what’s going to happen next, the small MEMS companies are hunkering down, cutting capital spending, travel, bonuses and R&D,” Mounier said. “But many remain optimistic of continued growth going forward, with 49 percent of companies planning to invest in additional MEMS equipment sometime this year and 30 percent planning to hire additional staff.”

Cell phones still are expected to drive MEMS demand in the future, but some exciting new applications also are anticipated. Mounier predicts that future ones will cover microbolometers, MEMS digital compasses and oscillators.

“MEMS oscillators are now ready to take a significant share of the timing market, in replacement of quartz oscillators,” he said. “Digital compass is a soaring market in 2010 that started in earnest in 2007, thanks to the first monolithic three-axis devices. These will represent future promising markets.”