Trends to Watch in Photonics in 2024

The world did not become a better place in 2023. But some parts of the photonics industry made remarkable progress. And that will endure.

The world of photonics is changing. In some places at a slow pace, in others by leaps and bounds.

Laser equipment for materials processing, what many people regard as “the laser market,” looks rather mature and is steadily evolving. Elsewhere, the photonic solutions for telecommunications and computing that have often been regarded as a part of the semiconductor world are now set to conquer that realm. Big things are happening in that sector, and timing could be crucial in determining who will benefit most from current trends.

Finally, there is laser fusion. Will it save the earth? Probably not any time soon. But it might have some short-term impacts you are not aware of.

Lasers mature

For many decades, lasers were a pioneering and cutting-edge technology. Today, they are commonplace. Your car, the displays you look at all day, and the integrated circuit chips in your smartphone, they are all produced using specialized laser systems. Lasers have found their way into manufacturing on a large scale. The actual light source in the large cabinet on the factory floor is no longer a selling point.

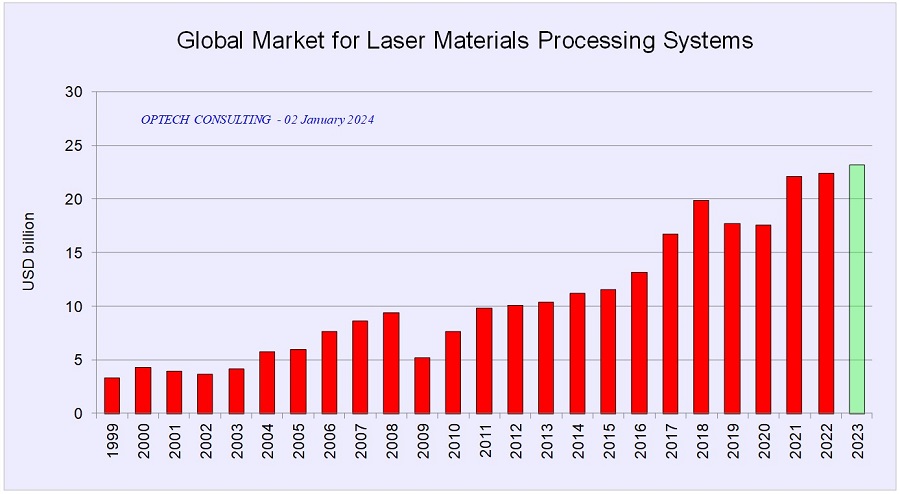

The global market for laser material processing systems showed moderate growth in 2023 towards $23 billion. Courtesy of Optech Consulting.

Arguably, lasers have become a commodity, and even kW-class fiber lasers increasingly compete by price. In the Western world, that has led to a wave of mergers and acquisitions in recent years while it has turned China, the biggest market for industrial laser systems, into a battleground for a vicious price war.

System providers must therefore find new sales pitches for their goods, especially — but not only — in China. “Those price wars will gradually evolve into competition with customized solutions,” said Bo Gu, president of BOS Photonics. “A high-quality engineering team and a reliable service will bring a huge competitive advantage to the enterprise.”

That matches my observations: Laser system providers are trying to differentiate themselves by highlighting technical features, such as flexible beam shaping or additional process control features.

Another trend that Gu shared with me involved laser suppliers showing more reliance on joining groups and crossing boundaries. “In light of economic weakness and depleted profits, strong cooperation between enterprises will replace vertical integration and become the trendy business model of the Chinese industrial laser industry in the post-epidemic era,” he told me. “In addition, some downstream large companies have crossed the border and entered the field of laser equipment manufacturing.”

Within the next months we will see how the actual numbers evolve. So far things look positive for the Chinese laser market. “Despite the complex and severe international geopolitical situation and the weak global and domestic economic recovery after COVID-19, the Chinese laser market still achieved 6.5% annual growth reaching $14.43 billion in 2023,” Gu reported. He predicts the annual growth for the Chinese laser market in 2024 to be 10.2%, driving the sector’s revenue to $15.9 billion.

Arnold Mayer from Optech Consulting is a seasoned analyst with decades of experience watching the market for laser material processing equipment. He sees the global market for laser material processing systems up 2-5% in 2023, reaching a new record volume of $23 billion — subject to a final adjustment for Q4.

“Of the [globe’s] major laser equipment consumers, only the USA recorded healthy growth in 2023 while Europe and China lagged behind,” said Mayer. “On the global scale, we saw especially strong demand in laser welding, while cutting and microprocessing were left behind.”

Regarding 2024, Mayer does not see an immediate change of the present market trend, though he added positive developments may be in the cards, such as a recovery of the microprocessing market.

Photonics boost computing

As the prospects for photonics technology in material processing slow, they are speeding up in another sector: optical computing and data communications. Compared to electronics, photonic components promise more speed and lower energy consumption when moving data. The question that comes to mind is: What companies are best positioned to make the most money in this expanding market? We will come to that after a short look at the technology itself.

The comparative benefits of photonics with regard to processing speeds and transmission rates are so obvious that scientists predicted the advent of optical computers as early as the 1980s. People at Bell labs tried to create an optical transistor at that time.

It didn’t work.

One underlying problem is that photons do not interact with each other, at least not in the same way electrons do. The challenges are more nuanced than this, and I discuss them in more detail in a feature article to be published in the February issue of Photonics Spectra.

After several decades of refining the integration of silicon-based components, attention has turned to the opportunities offered by materials such as indium phosphide, indium nitride, silicon nitride and others, as well as new chip packaging technologies. There are a number of startups that have collected hundreds of millions in funding to convert the promise of these photonic platforms into new optical compute and data communication solutions. Lightmatter is one example of the former. According to Bloomberg, the company just reached a $1.2 billion valuation. They are developing several different technologies, including programmable photonic interconnect that enables conventional chips to communicate more quickly, as well as optical computing chips, and combinations thereof.

Anyone seeking to advance conventional (i.e. electronic) computing has to eventually offer a chip-scale solution. That assumes some form of partnership with a semiconductor fab to process chips, which is a multi-billion investment.

There are many individual challenges facing these integrated photonics pioneers. But one challenge nearly all of them will confront involves scaling their technology in a CMOS fabrication process. There are many pilot lines, institutes, and organizations set up to help small photonic integrators refine their designs for manufacture. But anyone seeking to capitalize on the fast-emerging demand for high-bandwidth data processing and communications will eventually need to partner with one of the larger semiconductor fabs, such as GlobalFoundries or Tower Semiconductor. The former has announced partnerships with photonic pioneers, such as Ayar Labs, Lightmatter, PsiQuantum, Ranovus, and Xanadu, among others.

Courtesy of Alex – stock.adobe.com.

Now, to get back to my initial question: Who among these companies is best positioned to make money from the emerging demand for photonic compute and data communications solutions? Obviously, the semiconductor giants could absorb the new technology and supply the market with whatever is needed to serve the AI trends and more. Those new technologies are particularly well suited to do calculations for artificial intelligence.

The larger players also wield more leverage when competing for materials in the photonic supply chain. That might have been a reason why several European companies sent a wake-up call to the European Commission in November 2023. Eight CEOs representing X-FAB (Germany/France), LIGENTEC (France/Switzerland), SMART Photonics (The Netherlands), Aixtron (Germany), PHIX Photonics Assembly (The Netherlands), VLC Photonics (Spain), Almae (France), and Photon Delta (The Netherlands) signed their names to a plan that proposed to accelerate the development of supply chains for photonics integrated circuits. They collectively asked the Commission for €4.25 billion in support over the next eight years. That number might give an idea of the scale and seriousness with which they regard the problem: If the Europeans do not catch up fast, the profits from this sector could go to the Asian and American semiconductor giants.

And by the way: Those who sell into the photonic quantum computing sector might need a wake-up call too. Photonic computing technology is very well-suited to serve photonic quantum computing as well and, thus, whomever serves the optical computing supply chain may easily serve the quantum computing supply chain as well.

Fusion future

I must admit that I love laser fusion. It is such an amazing technology. And the progress the sector has shown in the last 12 months is just mind-blowing. Still, it is too early to expect a reliable roadmap towards fusion power on the grid anytime soon. There is no experimental evidence for a number of basic questions, such as how to achieve net energy gain or how to establish continuous fusion operation? It is not even clear which target material would be best for fusion.

Nevertheless, (laser) fusion is a field for basic research and, accordingly, a number of funding initiatives took off in 2023. The American Department of Energy announced $45 million for Inertial Fusion Energy, and the German government even promised a billion euros in funding through 2028. What can be done with that money? Basic research, of course, to establish more knowledge as needed to get to answers to the basic questions.

But before that happens, a lot of that money will be spent for laser research. And that is where things become interesting. It will likely prompt a class of laser systems with short (ns or fs) pulses, high pulse energies (J to kJ), and high repetition rates (10 Hz to kHz). These will also all be diode-pumped, of course, which will be helpful for other fields such as secondary sources.

Fusion research will also drive component development for such ultra-high intensity systems such as plasma mirrors. In the end, we might see a tabletop source of accelerated electrons, protons, or neutrons much sooner than a continuous fusion experiment. That would be beneficial for material research, health care, and other fields of basic research. Funding is about to be spent in the next few years and so we may expect visible progress on the various fields of laser and fusion research.

There are also other corners of photonics that merit watching this year. Will defense lasers become a more notable market, for example? How high can the market for photonics for space soar? We will see. For now, I would conclude with best wishes for a successful and healthy year 2024. May the light be with you!

/Buyers_Guide/Ayar_Labs/c32997

/Buyers_Guide/Lightmatter/c32540

/Buyers_Guide/X-FAB_Semiconductor_Foundries_GmbH/c20982

/Buyers_Guide/LIGENTEC_SA/c31666

/Buyers_Guide/Smart_Photonics/c30559

/Buyers_Guide/PHIX_Photonics_Assembly/c31818

/Buyers_Guide/VLC_Photonics_SL/c22100

/Buyers_Guide/Almae_Technologies/c32654

/Buyers_Guide/PhotonDelta/c32688

/Buyers_Guide/Ranovus/c30661

/Buyers_Guide/GlobalFoundries/c33007

/Buyers_Guide/Tower_Semiconductor_Ltd/c17337