This autumn, the quantum community held multiple meetings. Everyone is poised for growth, but scaling the technology is more difficult than expected. Can lessons from the semiconductor industry help?

ANDREAS THOSS, CONTRIBUTING EDITOR

October is beautiful in Munich. Hotel room prices relax after the end of Oktoberfest and local parks display autumn colors while the weather is still pleasant. Such was the setting when EPIC held its recent technology meeting on Industrial Quantum Photonics Technology on the premises of TOPTICA Photonics AG on Oct. 11 and 12.

During the same week, Messe Stuttgart hosted its new Quantum Effects congress. One week later, the German community convened again in Hannover at the European Quantum Technology Conference (EQTC). In November, U.S.-based Optica will hold its Quantum Industry Summit at LIGENTEC in Lausanne, Switzerland.

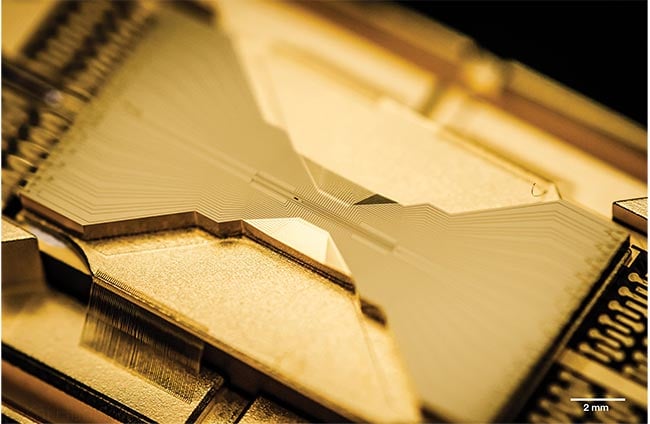

IonQ’s latest-generation ion trap prior to being installed in its 32-qubit system. Courtesy of Kai Hudek, IonQ

This much activity would suggest significant developments are afoot. It is time to take a look to see what common trends and questions might be arising.

Make it small or let it go

Governments have committed large sums of money to support the development of quantum technology in both academia and industry. This funding has sparked many projects throughout the field, and evolution is apparent in quantum key

generators on satellites, super-precise clocks, various sensors, and, of course, quantum computing.

Computing, in particular, enjoys strong funding from industry. But despite this, there are still a relatively small number of companies that produce quantum computers. IonQ in College Park, Md., is among this limited crowd. As part of a German delegation that visited the company in late September, I had the chance to gain an impression of the current state of quantum computers. In IonQ’s case, they comprised towers with 19-in. racks. European companies, such as SaxonQ and Alpine Quantum Technologies, presented quantum computers in similar racks at the October EQTC meeting.

Peter Chapman, president of IonQ, showed his German visitors a next-generation optical quantum processor, a miniaturized ion trap smaller than a human fist (Figure 2). Chapman spoke about the necessity to reduce the size and cost of quantum computers considerably within the next five years. Integration and miniaturization may be a general trend for quantum technology, but for a publicly traded quantum company, it is a matter of survival.

A similar theme was evident at the EPIC meeting in Munich. “Packing more and more components on optical tables is not sustainable,” said Stephan Ritter, TOPTICA’s former director of Applications for Quantum Technologies. Therefore, TOPTICA puts its lasers for quantum applications into racks as well, as it thinks about the next level of integration.

The future is hybrid

Though quantum computers often make the headlines, their technological maturity is still quite insignificant. Basic functions such as error correction, data storage, or logic gates remain in an experimental stage at best.

Quantum communication technologies are farther along the technology readiness scale. There, developers can build on proven telecom components and technologies, and there is demand from customers to accelerate toward so-called quantum-safe encryption technologies.

As early as 2016, the National Institute of Standards and Technology (NIST) requested the development of post-quantum algorithms based on the risk of quantum computers’ breaking current encryption protocols. Since then, a wide range of countermeasures have emerged. They can be sorted into two groups of methods: one based on post-quantum cryptography (PQC) and the other on quantum key distribution (QKD).

In simple terms, PQC extends known encryption algorithms, whereas QKD uses photonic sources for the generation and distribution of secure quantum encryption keys. End users may decide to apply one or the other, or both, said Johanna Sepúlveda, Airbus’s chief engineer and technical domain manager for Quantum Technologies, during EPIC’s Munich meeting. For her, QKD or PQC is not a polar decision but rather a question of hybridization. Accordingly, Airbus plans to set up a quantum-secured space backbone in 2027 and develop several technologies for PQC in parallel. Both developments go hand in hand.

This underscores the trend toward hybridization in quantum communication: Different technologies will complement each other to deliver maximum security. In quantum computing, hybridization could lead to systems that combine conventional CPUs with quantum processors. Each would do what it does best and compensate for any weaknesses in the other.

This raises another takeaway from the Munich meeting: Most quantum technology will be based on electronics. In a layered approach to quantum computing, optical technology will be implemented at the lowest levels. Above it will be electronic driver hardware, driver software, and, on top of the technology stack, conventional software to communicate with users or other machines. This architecture is already apparent in quantum communication, where the QKD unit is just an optional device that can be included on the physical hardware level.

This should not lead to any underestimation of the seriousness of the transition. Marc Nikles, chief marketing officer of Switzerland’s ID Quantique, said that the “migration to quantum-safe is the largest cryptographic migration ever.” He referred to companies being asked to prepare reports on how vulnerable their systems are. “Discovery, cataloging, and triaging is difficult, manual, and error prone,” Nikles stated.

Supply chains will change, but when?

In recent years, optical and optomechanical equipment suppliers have seen solid revenues from the field of quantum research and development projects. What effect will the technology shifts from optical tables to racks to integrated solutions have on these businesses? And if overly optimistic market predictions come true and quantum becomes a multibillion-dollar market, who will control the supply chain? Will small suppliers grow, or will large companies take over an evolving

market? One thing seems certain: The supply chain will undergo massive changes.

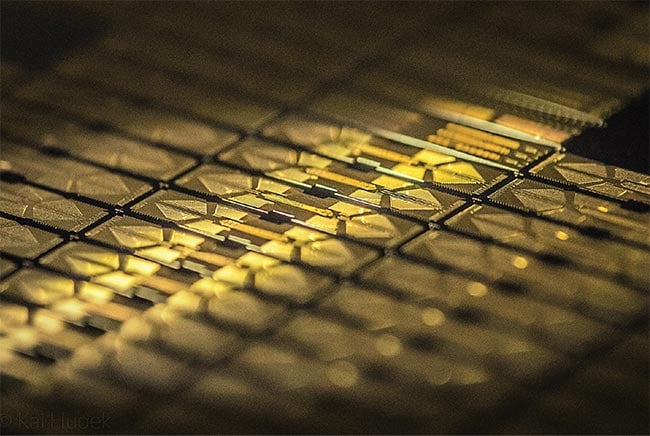

During the European Photonics Industry Consortium’s (EPIC’s) October quantum meeting in Munich, QuiX Quantum presented its Quantum Photonic Processor, the core technology for the company’s quantum computers. The device has 20-mode capability, and the latest generation will offer 50 modes. Courtesy of QuiX Quantum.

Component suppliers are already affected by these trends. “Everybody asks for lasers that are smaller, cheaper, and even more precise,” said Wilhelm Kaenders, founder and president of

TOPTICA during a conversation about the upcoming challenges. “The supply chain for lasers will continue to need

substantial investments to solve that task and [achieve] larger volumes to justify such efforts. When needed, the availability of suitable quantum enabling components is by no means granted.”

An expanded investment might solve one issue, but there are remaining questions. Martin Schell, executive director of the Fraunhofer Institute for Telecommunications, Heinrich-Hertz-Institut (Fraunhofer HHI), compared developments in the photonics supply chain against his background in the semiconductor industry: “In the semicon community, industry associations and roadmaps have been developed already 30 to 40 years ago,” he said. “Further integration in photonics will need similar activities to develop standards that are next to solve in quantum technologies.”

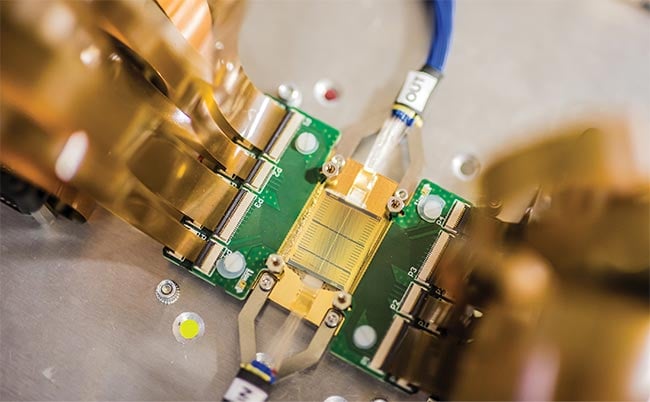

A test wafer used in the ion trap manufacturing process for IonQ’s quantum device. Courtesy of Kai Hudek, IonQ.

Of course, there are a few differences between the semiconductor and photonics realms. First, photonics technology is far more diverse. In the semiconductor industry, silicon has been the sole material system for decades, and the whole supply chain has adapted to that. Photonics, in contrast, uses several material systems for light generation. Optics may add more materials. Further, telecommunications systems operate on two wavelength bands and, as TOPTICA advertises, quantum technologies will demand solutions at “all wavelengths.”

Finally, there is a huge difference in market capitalization between the two industries.

The five biggest semiconductor companies — ASML, Broadcom, Samsung, TSMC, and NVIDIA — add up to a $2.4 trillion market cap. The largest public photonics companies are Coherent, valued at $4.7 billion, and Hamamatsu, valued at $6.4 billion. One can also value some of the privately held photonics companies by their revenue. TRUMPF, for example, has made over $5.5 billion and Zeiss over $9 billion in revenue last year. Neither come close to the approximately $22.5 billion that ASML — the smallest of the semiconductor industry’s top five — reported at the close of its last fiscal year. Further, it is worth mentioning that the biggest photonics companies derive a large part of their revenue from semiconductor manufacturers.

Lessons from semiconductors

So, it is evident that the photonics sector is much smaller and characterized by more diversity compared with the semiconductor industry. Market analysts, such as Eric Meunier from the Yolé Group, forecast a market of several billion dollars for quantum technologies by 2030. At the Munich meeting, he shared Yolé’s latest estimate of more than $1 billion for the quantum computing market, which did not account for the technology’s numerous military-driven activities. This estimate is substantially more than the $111 million Meunier accounted for in 2022. But, in general, his current numbers look very conservative.

A frequency-comb-stabilized laser system for the synchronization of atomic qubits in telecom quantum networks.

Courtesy of TOPTICA Photonics.

Whatever value quantum might grow to, a change in the form factor of quantum devices is coming. Miniaturization and integration will be a universal trend for all quantum devices, from the smallest sensor to the biggest computer. As noted above, this demand will require implementation of new standards and roadmaps, such as the one initiated by the

European Committee for Standardization1. Such plans are distinct from the product roadmaps issued by IBM or Google.

Even with the emergence of new standards, scaling up the production of

integrated photonics components for

quantum applications will require essen-

tial investments in new technologies. This ramp up will be difficult for small- and medium-sized enterprises (SME) to achieve.

To solve this problem, the European Union (EU) has supported the development of so-called pilot lines where governmental funds are used to establish test and manufacturing capabilities and make them more available to SMEs.

JePPIX is one of those EU pilot lines. Located on the campus of Eindhoven University, JePPIX focuses on indium phosphide-based PICs. They offer foundry services for components up to technology readiness level 7 and have realized more than 800 PIC designs according to Martijn Heck, a professor at Eindhoven University and one of the speakers at EPIC’s Munich event.

Heck’s vision for future quantum PICs assumes a modular platform that is flexible in the wavelength it employs and possibly suitable for applications in ion-, cold-atom-, superconductor-, and diamond-based approaches to quantum computing.

Europe’s latest PIC pilot line project refers directly to quantum interests. The Qu-Pilot comprises an ecosystem of 21 partners from nine countries and supports

experimental quantum production facilities. The EU provided €19 million

($20 million) to support the project for

42 months.

The end goal is to accelerate the time-to-market of European industrial innovation in quantum technology and to establish a trusted supply chain, according to project organizers. Their approach further aims to include the creation of a viable commercial and business roadmap for its long-term operation.

It’s getting cold outside …

In the quantum realm, winter is coming. After years of receiving hefty funding, expectations for the technology’s future remain high. But the path to commercial products and big market gains is long. Many startups showed at the various meetings this autumn how they turn quantum research into products. Miniaturization and integration are already common goals. The next step entails upscaling production capacities in the supply chain. Looking to the semiconductor industry may help to supply guidance on the road to success. But the diversity of photonics will make this road long and challenging, and not every project is likely to survive the lab-to-fab quantum winter.

References

1. CENELEC. Standardization for Quantum Technologies, www.cencenelec.eu/news-and-events/news/2023/brief-news/2023-03-22-standardization-for-quantum-technologies/.