2024 has been an exciting year in photonics, even if some of the predicted concerns have come true. Forecasting is challenging, and along with some uncertainty for manufacturing, new technologies are emerging as focus shifts to the new year.

BY ANDREAS THOSS, CONTRIBUTING EDITOR

The year 2025 is only just now upon us, but it is already facing many concerns: Politics will change (America) or face instability (Europe), and the threat of various conflicts will alter supply chains. In industry, auto manufacturing is undergoing significant changes. At the same time, the outlook for the semiconductor industry is slightly positive. Nevertheless, some companies fear for their existence. I won’t dive into political discussions, but I would love to share a few trends that I find to be worth watching in 2025.

The industrial laser market, the prospects for profitability in laser fusion, and semiconductor manufacturing are among the trends to monitor in photonics heading into 2025.

State of affairs in the laser market

Before we go into detail, it is important to decipher between the terms “laser market” and “laser industry.” As a first approximation, the laser industry could include any company that manufactures laser sources or machines in which the laser is an essential component. The laser market is often divided into the market for laser sources and the market for machines that incorporate a laser source.

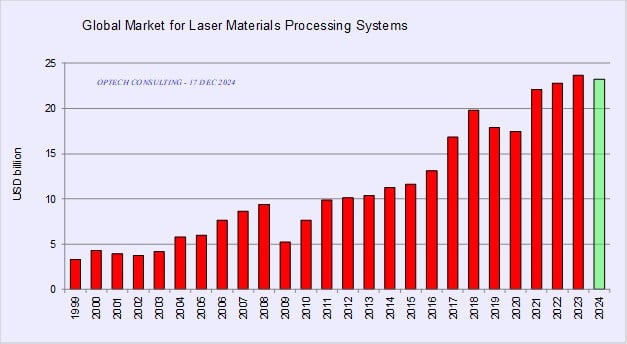

Looking at all of these details requires a lot more space. We will restrict ourselves here to considering the number of machines sold, rather than the number of laser sources produced. This is something that Arnold Mayer from Optech Consulting has done for some decades. I have asked him for a first review of the numbers for the market for laser machines for materials processing in 2024 (Figure 1).

Mayer sees the 2024 global market for laser materials processing systems at $23 billion. Subject to a final adjustment for Q4/2024, the market is down by 1% to 5% from the record high of $23.5 billion, which the sector reached in 2023. “This year, only smaller markets showed growth, while the demand in North America and Europe was down and China trended sideways,” Mayer said. “By application, we saw a shift of growth from macro- to microprocessing. The demand for laser microprocessing equipment, which had been weak for two years, partly recovered in 2024. In contrast, the cutting systems market decreased for the second consecutive year, while market growth in welding slowed due to the maturing e-mobility market in China.”

Looking to next year, Mayer said that the available information suggests that current market trends will persist in early 2025: We may see continued strength in microprocessing but also continued weakness in the macro- segment. While Mayer expects a basic growth trend in the market for laser materials processing, he can’t confirm that this trend will endure for the whole year.

In other words, the glass ball is foggy. More seriously, trends can change over the year.

Figure 1. The global market for laser material processing systems showed a moderate decrease in 2024 at the level of $23B.Courtesy of Optech Consulting.

AI drives photonics toward semicon

Photonics has revolutionized telecommunications and data transfer. The internet as we use it would not be possible without data transmission in optical fibers. But these end at the backside of your computer or router. The respective question that arises has been around for a long time: When will photonics make it to the PCB (printed circuit board) level or even to the chip level?

It looks as if the answer is — now. In 2024, billions have been invested in companies that push photonics on the PCB and on the chip level. Things are rolling. The actual question now: How far will they go?

The ultimate goal would be to bring photonics to the processor level. For a long time, such photonic processing units (or PICs) were the “next big thing.” It looks now as if industry is turning instead to photonic interconnects.

In October 2024, Google Ventures invested $400 million in Boston-based startup Lightmatter. The company’s promise is to accelerate interconnections between regular chips. An interview with Lightmatter CEO Nick Harris (published in TechCrunch) focused on interconnecting AI processors with an all-optical interface.

According to the article the photonic interconnect currently available from Lightmatter achieves 30 terabits, and the on-rack optical wiring allows 1024 GPUs to work synchronously in their own specially designed racks. Lightmatter’s valuation has jumped to $4.4 billion.

A number of other companies (Ayar Labs, Xscape, Celestial AI) are also working on optical interconnects. In December 2024, Silicon Valley-based Ayar Labs raised $155 million to accelerate high-volume manufacturing of its in-package optical interconnects. Investors included AMD Ventures, Intel Capital and NVIDIA. The chiplets from Ayar Labs are produced by GlobalFoundries on their Fotonix process (300-mm silicon wafers). The company, which is currently shipping thousands of samples, is targeting AI infrastructure. But it is also testing applications in cellular communications, aersopace, and radar. One should mention here that photonics enters data centers or other professional structures. I doubt that we will see the same tech in consumer devices any time soon.

Photonic interconnects and chips promise lower energy consumption, higher bandwidth and lower latency. This is the reason why AI benefits from optical interconnects already. Packaging remains an issue here, since photonics and electronics work in quite different ways. And thus, they may stay on separate chiplets in architectures of the future.

This design consideration seems even more challenging with PICs. PICs need integrated lasers, waveguides, beam splitters, detectors, modulators etc. And for these components, there are more materials under investigation, including silicon nitride, lithium niobate, barium tantalate, graphene, aluminum oxide, aluminum nitride and more. This is likely to lead to many new supply chains. Nevertheless, the PICs ecosystem is growing, and many different projects and startups are emerging. This should be a technology and set of trends to look at again next year again.

How to make money with fusion

On Oct. 16, The New York Times published, “Hungry for Energy, Amazon, Google and Microsoft Turn to Nuclear Power.” Google expects up to 500 MW from small modular reactors (SMR) to get on the grid between 2030 and 2035. Amazon put $500 million into SMR development.

It should be mentioned that these engagements represent small fractions of the companies’ hunger for power and their desire to become carbon-neutral.

When I read this news, I was wondering when we will learn about such engagement with (laser) fusion technologies. Not any time soon, I guess. We have seen several investment rounds in fusion startups in 2024, but nothing more than two digit million amounts. These investment values are enough to build another laser facility. But they are far from the investments that constructing a fusion test facility would command.

I interpret this as a need for more research. Much more basic research. Surely, the National Ignition Facility (NIF) again made incredible progress toward 5.2 MJ output in 2024. But painful questions remain unanswered. Which laser fusion process will achieve net gain, i.e. produce more energy than the laser needs? What does a target that is producible in large numbers look like? I would say that a Nobel Prize awaits the team that finds experimental proof for a pathway to net gain.

Which does not mean that we must sit and wait for the answers. Not at all. At least two lessons can be learned from NIF right now. The first is that we will need pump lasers that are bigger and more efficient than anything we currently have. And we will need optics that can withstand a long time of high power/energy/intensity operation. Again, they must be better than anything we have.

In Germany, several projects have started with governmental and private funding to prepare essential building blocks for a laser fusion power station. One named "DioHELIOS" unites the brightest minds in laser diode research to develop more efficient laser diodes and efficient manufacturing technology for them. On the industry side, it is TRUMPF, Jenoptik, Laserline and ams OSRAM. On the research side, experts from the Fraunhofer Institute for Laser Technology ILT and the Ferdinand-Braun-Institute FBH will contribute. They are targeting pump modules with MW power and costs below one cent per Watt. Another project “PriFUSIO” looks at the optics. Project participants on this initiative want to establish know-how along the supply chain for durable laser optics including gratings, mirrors, substrates, and coatings.

A third project, "Planet," goes even further, looking at applications beyond laser fusion. The project is led by the fusion startup Focused Energy (with a little help from TRUMPF), and the partners are planning a laser-based neutron source. Earlier this year I wrote about applications of such secondary sources. This may hint at a first spill-over business case: Once you have a modular high-power/energy/intensity laser, you can do a lot with it — from materials science to debris mitigation in low Earth orbit.

Presently, we see that even while the actual laser process for fusion hasn't yet been defined, lasers and optics for fusion may soon be contributing to the profits of their manufacturers. Again, this is about supply chains.

These are three topics that I thought worth looking at. There are many more, of course. Laser communication terminals (LCTs) for intersatellite data transfer, for example, are projected to take off in 2025 as a laser market segment. A full feature on LCTs runs in the March 2025 issue of Photonics Spectra. Quantum technologies also deserve their own review. Lasers in automotive manufacturing would further be interesting to explore (at a time when e-mobility is taking off).

2025 will be an exciting year, and also in photonics. Things will change, probably more than in other years, and we hope for the better.

[email protected]