ANDREAS THOSS, CONTRIBUTING EDITOR

The International Laser Marketplace Seminar, traditionally held as part of the LASER World of Photonics event in

Munich, has provided a reliable source for market and trend information in the field of industrial laser systems. Global markets for industrial lasers have changed considerably since analyst Arnold Mayer of Optech Consulting introduced the seminar 32 years

ago.

“When we started the Laser Marketplace in 1992, the laser as an industrial tool was new and just started to replace established methods on the shop floor,”

he told Photonics Media.

Courtesy of iStock.com/Dreamland Media.

In the early 1990s, for example, Japan was the largest end market for laser systems.

“Japan was catching up rapidly in laser usage with the USA and Europe, and it was the time of the Japanese industrial

bubble,” Mayer said. When asked about parallels with today’s laser boom in China, he said: “The difference is that China’s large share in laser materials processing is founded on a large share

in global industrial manufacturing,” (Figure 1).

To see just how much things have changed in three decades, it is possible to take a look at the seminar’s very first lineup1.

In addition to Mayer’s analysis on the global laser market, this year’s edition of the seminar also featured analyst insights on the Chinese and Indian laser markets plus corporate perspectives on hand-held laser welders and UV laser processing applications in the microLED display market.

The bigger picture

In his overview of the current global laser market, Mayer made a point to distinguish between laser systems (i.e., machines for materials processing) and lasers (i.e., the actual laser oscillator components inside laser systems).

From there, he broke the market down further by macro- and microprocessing application segments.

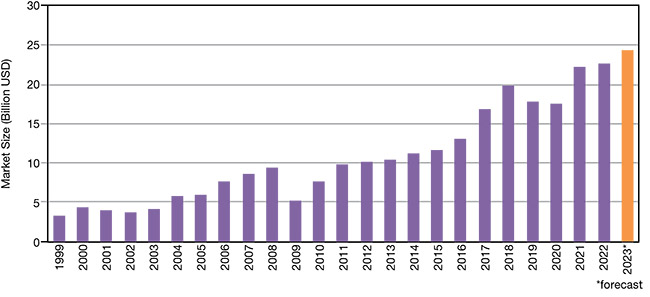

Macroprocessing, which encompasses laser cutting, welding, marking, and additive manufacturing applications, comprises 75% of the $23 billion global market for laser materials processing systems. Laser microprocessing comprises the other 25% market share, and includes systems for microelectronics manufacturing, including structuring, drilling, annealing, and other applications. The microprocessing segment also includes laser oscillators for microlithography, though not microlithographic systems, which fall under the multibillion-dollar market for semiconductor manufacturing tools.

According to Mayer, the global end markets for laser systems break out as

follows: China 34%, Europe 18%, America 18%, and other regions 30%. Mayer emphasized that these market volumes only include the value of the laser systems without consumables and services.

The total market has made some remarkable jumps in recent years. Mayer expects to see an overall growth rate of 5% to 10% for this year, when calculated as nominal growth that is not adjusted for inflation. This aligns roughly with market growth in China, as projected by Bo Gu, owner and CTO of BOS Photonics. Gu’s forecast favors the upper limit of Mayer’s range since the Chinese laser market has long shown growth rates of twice the gross domestic product growth in China, which Gu expects to lean toward 5% in 2023 (Figure 2).

Figure 1. According to BOS Photonics, China has become the world’s biggest market for laser tools. After China reached 58.6% of global market share in 2022, Gu expects to see the country achieve 60% market share in 2023. Courtesy of BOS Photonics.

Figure 2. Chinese fiber laser market size between 2014 and 2023. The fiber laser market in China remained stable in 2022, with a minor increase in sales volume during 2021, but a decline in revenues and profit margin. Courtesy of BOS Photonics.

Price war in China

In 1992, it was a serious endeavor to buy a laser system or to build your own machine. In 2023, end users occupy a very different world. Today, many laser systems are commodities, and people do not consider assembling their own.

China has also become the biggest laser market in the world. As Gu noted in the July 2023 issue of Photonics Spectra, China has seen a multiyear price war that has brought many fiber laser companies to the brink of bankruptcy2. At the 2023 Laser Marketplace Seminar in Munich, Gu made it clear that this price war in China is not sustainable, noting that

“Nobody is making money there.”

But as the total revenue numbers for fiber lasers dropped slightly in 2022, the numbers for unit sales exploded. This, in turn, has enabled a lot of new installations. The markets for both cutting and welding systems are growing rapidly in China. For example, Gu forecasts the market for welding systems to grow

by 44% during the last year to reach

$4.2 billion in 2023. This expansion is probably driven by battery welding applications, since 75% of all batteries come from China currently.

A rather new market sector is laser additive manufacturing, in which Gu said 16% of the annual growth during the last year will push China’s market to $2.8

billion this year. Ultrafast laser systems (i.e., lasers with pulse durations in the pico- and femtosecond realm) signal another major trend. After reaching $913 million in revenue last year, China’s market for these lasers might cross $1 billion in size this year. Domestic manufacturers in China are catching up with this technology. According to Gu, any products delivering <50 W of average power are already in Chinese hands.

India — when will the lion awake?

Maulik Patel, executive director at laser manufacturer Sahajanand Laser Technology Ltd. (SLTL Group), presented a well-received introduction to the Indian laser market, in which the macroeconomic numbers are promising. A growth of 5% to 7% in overall industry production is expected, according to Patel, who added that India’s finance ministry claims that the country’s economy has become the fifth largest in the word.

Does that make India a large laser market? Not yet.

Patel showed revenues of $165 million for laser cutting systems, $26 million for laser marking systems, and $20 million

for laser welding systems in 2022.

Imports from China dominate most of these fields with steep growth that has been evident during the past three years. The sales volume of Indian laser manufacturers is growing, but with less market share than their Chinese competitors.

In fact, the share of Indian manufacturers in the market for laser cutting systems

fell from 47% in 2020 to 39% in 2022, while the Chinese share grew during that period from 31% to 47%, as Patel reported. Imports from other countries including Europe and the U.S. continued to fall and only made up for a combined 14% share in 2022.

How (and why) fiber lasers dominate

A few technical trends drew comments at the seminar this year. A basic one, Mayer observed, is that fiber lasers are replacing other lasers in mainstream applications, such as cutting. About 50% of the revenue from laser oscillator components that are sold for materials processing comes from fiber lasers. By unit, fiber lasers dominate the market with a share of >90%. While the unit price has dropped, total revenue has grown because more units are being produced and subsequently overtaking new applications with lower unit prices. Figure 3 illustrates the rationale for this trend by providing a rough estimation of how the cost in dollar per watt for high-power lasers dropped over thirty years (Figure 4).

Figure 3. Global market for laser materials processing systems. After a small change in 2022, the global market for laser materials processing systems is forecast to grow this year by about 5% to 10%. Courtesy of Optech Consulting.

Figure 4. High-power lasers for materials processing. The dollar-per-watt cost of output power dropped remarkably for high-power fiber and CO2 lasers during the last 30 years. Courtesy of Optech Consulting.

The other 50% of the revenue from laser materials processing applications is shared mainly by bulk solid-state lasers and gas lasers, which include excimer lasers for display manufacturing. TRUMPF’S exhibit at LASER World of Photonics 2023 presented its first 720-W solid-state UV laser. At Coherent’s booth, representatives spoke of a similar development, addressing the display manufacturing market.

So, there is reason to believe that solid-state lasers could continue to encroach on traditional gas laser applications.

Some laser tech trends

The Laser Marketplace Seminar traditionally includes a few executives offering new or very solid technology ideas. This year, the first speaker on this list was Jianwu “Jim” Ding, CEO and CTO of China’s GW Laser Technology. Ding spoke about the exploding market for portable laser welders, for which he estimated sales could reach between 100,000 and 200,000 systems this year in China. All major Chinese laser system manufacturers offer such devices and Ding expects 100% annual growth for at least the next two years.

Applications for these devices center on welding 2- to 3-mm stainless steel or aluminum. Their average output power is between 1.2 and 1.5 kW and, more rarely, 3 kW and beyond. Most of them are water-cooled, but the number of air-cooled systems is catching up and Ding expects that by 2025 >50% of the hand-held lasers will be air-cooled.

The export of these devices has remained <10,000 in 2022, but these numbers are expected to multiply during the next few years. Lasers might be much more expensive compared to arc welders, but they are 3 to 5× faster and need no pre- or post-welding cleanup.

Oliver Haupt, director of strategic marketing for display capital equipment at Coherent, spoke next, and he highlighted the effect lasers can have in the fast-growing MicroLED market. MicroLEDs are expected to be the next big display technology following LCD and OLED and are expected to come into full fruition by the end of this decade.

This emerging market could further extend the range of laser applications in display manufacturing, a list that already includes the use of lasers for annealing low-temperature polycrystalline silicon thin-film resistors, lift-off debonding

techniques, laser-induced forward transfer printing techniques, laser-based repair and assisted bonding methods, and the cutting of glass and flexible substrates (Figure 5). Display manufacturing might be a market with only a few contractors, but Coherent is obviously positioning itself to offer future-proof solutions in the years to come. Its portfolio for the sector range from deep-UV laser sources to turnkey solutions at 248 nm.

Figure 5. A 100-W UV laser, such as Amplitude Laser’s Tangor 300, cuts OLED panels 3× faster than a 30-W laser. Courtesy of Amplitude Laser.

Ultrafast lasers delivering kilowatt pulse powers were another trend to watch. (See “Ultrashort-pulsed lasers ramp up the power” in this issue) Vincent Rouffiange, VP and director of sales and marketing at Amplitude Laser, showed where it stands at the moment. The average pulse powers of these lasers are a key parameter for enabling new and more efficient applications, so market demand has put constant pressure on manufacturers to drive average pulse powers up. Currently, 300-W systems are available, but Amplitude is developing next-generation systems that aim to deliver kilowatt output powers.

What are such systems good for? Semiconductor and display-processing processes have used ultrafast lasers for many years, but new applications in aeronautics and automotives are expected to arise with the emergence of higher-power laser systems. Texturing of metal surfaces will also make use of kilowatt output powers, as will the new field of secondary sources that use ultrafast laser pulses to create brilliant x-rays, electron beams, or even proton beams. This is still a subject of research, with big prospects in medical treatments or nondestructive testing.

What does the future hold?

Mayer identified a number of laser market drivers during his seminar presentation. Among end users, there is demand for more automated yet flexible laser production tools and further miniaturization, as well as a growing interest in zero-failure production. At the same time, there is a supply-side push to deliver ever higher laser parameters at lower costs and to

develop new application technologies, such as solid-state UV lasers.

These trends on the technology side are confronting trends in regional markets such as the price war in China, onshoring policies in Europe and the U.S., investment cycles in end markets such as the semiconductor industry, and acute crisis events such as the SARS-CoV-2 pandemic. Nevertheless, the underlying theme of this year’s Laser Marketplace Seminar suggested it seems safe to predict over-average growth in coming years. Mayer calculated a compound annual growth rate of 7% to 8% for laser markets until 2028, assuming steady global economic growth and the inflation rate to decrease to 2% by 2028. The laser has become a mature tool in many markets, but sales of laser systems are still growing faster than the market for conventional machining tools.

References

1. Program of the first Laser Marketplace (1992). https://optech-consulting.com/1st_laser_marketplace/.

2. B. Gu. (2023). China’s Industrial Laser Market Shows Post-Pandemic Recovery. Photonics Spectra, www.photonics.com/Articles/Chinas_Industrial_Laser_Market_Shows/a68985.