The lack of qualified technicians in the photonics industry is a well-known problem that is particularly acute in the highly specialized realm of integrated photonics.

The challenge of finding, recruiting,

training, and retaining talent is putting pressure on businesses in every photonics market segment, in all geographic regions. But the skills gap presents particular challenges for the industry’s more emergent sectors, such as the fast-growing field of integrated photonics.

The growing demand for photonic

integrated circuits (PICs) has put

particular pressure on integrated

photonics firms to find qualified technical

workers who are able to fabricate

systems, run tests, diagnose production

problems, and recommend design changes. Courtesy of Infinera.

Earlier this year, Research and Markets estimated that the global photonic integrated circuit (PIC) market would surpass $3.5 billion by 2027. This level of growth was echoed by other market analysis firms, which achieved a general consensus that the size of the PIC market in 2020 was in the $530 million to $590 million range.

The widespread adoption of applications that is propelling growth in the PIC market is global and diverse. Designers in optical communications, sensing, signal processing, and biophotonics use PICs to power their components and devices. And the chips are effective activators for photonic communications technology, chemical sensors, lidar, optical test and measurement equipment, and instruments for the life sciences.

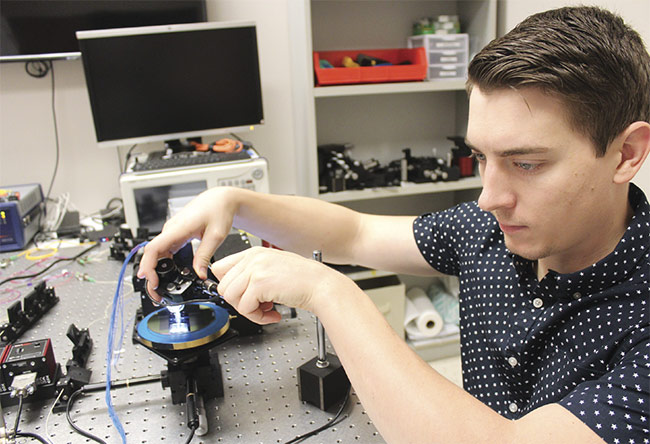

The growing demand for PICs has put particular pressure on integrated photonics firms to find qualified technical workers who are able to fabricate systems, run tests, diagnose production problems, and recommend design changes. Yet applicants for these positions often lack the skills they need to be immediately productive.

This skills gap among applicants is one concern. Another is the intensive, hands-on training that new technicians need. As the applications for PICs increase, the number of companies that rely on them surges. And while a prospective technician may have the skills to be effective in one setting, he or she may lack the skills required to be effective in another.

Operations managers surveyed

The skills gap can be measured by the overall number of positions expected to open in the next decade and the number of different types of positions that are likely to arise. A recent survey of operations managers in the U.S. fiber optics and silicon-based integrated photonics supply chain reveals as much.

The survey was funded by the U.S. Department of Defense, the state of Massachusetts, and MIT’s Office of Open Learning, and it was conducted earlier this year by MIT’s Initiative for Knowledge and Innovation in Manufacturing (IKIM). The survey queried operations managers from more than 50 photonics firms from around the country. Published under the title “Preparing the Advanced Manufacturing Workforce: A Study of Occupation and Skills Demand in the Photonics Industry,” the research aims to help industry chart a course toward a sustainable, qualified, and up-to-date workforce.

Randolph Kirchain, research scientist within IKIM and leader of the team that published the report, said his team examined both middle- and lower-skilled positions to underscore why the photonics sector is a promising segment for jobseekers.

As the applications for PICs increase, the number of companies that rely on them surges. And while a prospective technician may have the skills to be effective in one setting, he or she may lack the skills required to be effective in another. Courtesy of SiPhox.

“One of the things that was important was to show individuals who might be interested in manufacturing that photonics is an attractive area to go into for a promising career,” he said.

Survey respondents continuously reinforced the notion that a significant volume of opportunities are available in domestic manufacturing, and in photonics manufacturing within that.

European R&D hubs, technological research organizations, technology platforms, networks, and industry associations contribute to the integrated photonics ecosystem through the cultivation of public/private partnerships, the development of curricula, and recruitment initiatives. Courtesy of Infinera.

“For several decades, we have been communicating to people that manufacturing is dying in the United States,” he said. “And as a consequence, it shouldn’t be surprising that not a lot of people are looking to that industry as a career. I emphasize both of these messages — that there is first opportunity on the career side, and also opportunity on the training side to do better training.”

The MIT report categorized the more specialized photonics technicians and engineering technicians employed by integrated photonics firms as middle-skilled occupations, and it classified semiconductor processors, optical equipment operators, and electrical and electronic assemblers as lower-skilled positions.

Of the 24 positions comprising the survey’s components and fiber industry groups, the role of photonics technician was indicated by respondents to have the strongest anticipated growth over the next five years — particularly in the components industry. Courtesy of GenXComm.

The survey projects that middle- and lower-skilled positions in the photonics industry will grow from around 58,000 at present to nearly 85,000 by the end of the decade. Accounting for expected retirement and separations, this translates to around 42,000 cumulative middle-skilled openings over the time period, or a need to hire about 3500 new middle-skilled workers per year. Engineering technicians, a subset of these workers, are expected to represent more than 22,500 openings throughout the decade, at a rate of hire averaging 2200 per year. These numbers suggest that the country needs about 140 training programs to meet the engineering technician needs of the photonics industry.

Photonics technicians in demand

To quantify employer demand and the hiring and training efforts required to fill workforce positions, the survey identified 12 distinct occupations and grouped them into the “components” and the “fiber” industries. The position of photonics technician, along with each of the occupations, was listed under both industries.

Of the resulting 24 positions, photonics technician was indicated by respondents to have the strongest anticipated growth over the next five years — particularly in the components industry. The report also identifies the skills that industry players consider the most critical for their workforce and offers insights into the likely difficulty companies will face when seeking applicants with such skill sets. Surveyed firms anticipated either strong demand or hiring challenges for every type of technical occupation evaluated by the study. But five occupations stood out for presenting strong or moderate demand and moderate to challenging difficulty when filling them. Photonics technician cracked the list.

Of the 12 positions the survey listed in the components group, the role of photonics technician was indicated as the hardest to fill by more than 70% of respondents. The survey classified hiring difficulty for a position as “hard” if filling it took more than 60 days.

Respondents identified the most desirable technician skills as the ability to build, install, test, and maintain optical or fiber optic equipment using devices such as lasers, spectrometers, and interferometers, as well as the ability to work with optical components.

In other words, survey results make it clear that there is a need for photonics technicians to receive more extensive training on how to fabricate and assemble optical systems, diagnose and resolve process or product problems, design and execute testing, and recommend design changes.

Technical difficulties

Austin, Texas-based GenXComm Inc. combines radio components with integrated photonics to enable full duplex mesh nodes for private and enterprise 5G networks. The company’s 4G LTE and 5G cellular mesh network is applicable to the manufacturing, medical, and agricultural sectors.

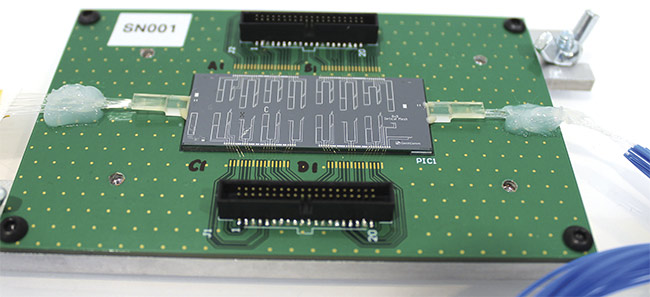

“We do everything from designing the process flow, to designing the devices and the process design kits, to fabricating PICs in-house,” said Thien-An Nguyen, GenXComm’s director of photonics. The company performs full integration of its PICs into systems before delivering the systems to end users.

GenXComm occupies what Nguyen calls a hybrid space that merges integrated photonics and telecommunications — two distinctly different fields. The ability to operate in either requires technicians to learn a highly tailored set of functions that extend beyond those specified in the MIT report.

Telecommunications and integrated photonics company GenXComm has found success in hiring technicians with physics backgrounds — though the company’s new recruits often require extensive training. The approach is consistent with the findings from a recent survey conducted by an MIT research team. Courtesy of GenXComm.

Namely, GenXComm technicians are commonly tasked with setting up tests on the company’s optical table, interrogating and characterizing devices on its photonic circuit, and performing post-silicon verification and validation. “They also need to have the physical understanding to know how the equipment that they’re working with interacts with the photonic integrated circuit,” Nguyen said.

Launched in 2016, GenXComm’s first wave of hires were experienced photonics engineers, most of them recent doctoral graduates.

“The wave after that were people who were more specialized,” Nguyen said. “And we hired them with the focus of just running the optics lab and running tests. And that’s when we realized, ‘you know, we really need to teach a lot of this.’” And every time a technician leaves, he said, it becomes more of a challenge to find a replacement.

“Photonics is really becoming more complicated as it becomes more miniaturized,” said Diedrik Vermeulen, co-founder and CEO of SiPhox Inc., an MIT spinout developing a next-generation biosensing platform that consolidates multiple laboratory instruments into a hand-held device. “It has raised the bar for technicians significantly. Tools are either becoming more complicated to use or, if the tools are easy to learn, technicians are required to have experience with many different kinds.”

Critical tasks that new SiPhox technicians must learn include how to formulate optical loss budgets. But, according to Vermeulen, the company spends the greatest amount of time teaching the recruits how to correctly handle chips and perform the optical alignment of fibers. “Everything related to integrated photonics is very capital intensive, from the fabrication of chips to the equipment to characterize and package these chips. And materials used, like fiber arrays and electrical probes, are so easily damaged.”

GenXComm’s Nguyen concurred. He said training photonics technicians takes longer than the training for many other positions because so many things can go wrong.

A technician in a haystack

For Infinera Corp., a manufacturer of optical transmission equipment and IP transport technologies, its position in the integrated photonics market requires the development and manufacture of large-scale PICs. The company’s Global Service and Support (GS&S) arm follows industry standard core qualification requirements that applicants must meet. Finding candidates that check all of these boxes, and then hiring and training them, is a time-consuming process.

“The vast majority of GS&S applicants coming out of school — at either level, bachelor’s or master’s — do not have the needed practical skills to jump right into the job and be impactful,” said Charlie Plitt, vice president of customer service Americas.

To ensure the probability of success, the need to hire qualified candidates preempts the need to train them. GenXComm deploys an approach that is the equivalent of taking a step back to, hopefully, take two steps forward.

“My approach has been finding graduates of physics programs, and training them to be photonics technicians,” Nguyen said. “That has been the most successful model.”

Such graduates at least have exposure to optics and other sciences, he said, and many of the laboratory skills they bring are transferable to the photonics technician role at GenXComm.

This approach is consistent with the findings of the MIT survey, which indicate that companies are more apt to fill openings with what it calls “common technician types” — such as electrical/electronic engineering technicians and industrial engineering technicians, among others — and then provide additional training after hiring.

Often this training can be extensive, however. The burden falls to both the engineers above the technician in the chain of command and the support workers below. Further, the skills learned for a photonics technician job at one company may translate poorly to another.

The MIT survey asked respondents which category photonics technicians fell into with regard to the amount of training required. A majority chose “extensive.”

Tough nut to crack

Infinera’s Plitt said the length of the company’s training time averages six months to get new hires productive. “While the GS&S team would welcome fully trained candidates just out of college and filled with practical experience, that simply isn’t reality. As a result, the GS&S team hasn’t changed its requirements but has changed its expectations and designed robust training programs to overcome the challenges,” he said. The company’s programs aim to close practical knowledge gaps and provide continual on-the-job training to upskill employees as photonics technologies evolve.

As an emerging technology, integrated photonics is not part of the formal

coursework at many schools, said Twan Korthorst, director of photonic solutions at Synopsys Inc. The reason is, in part, that the technology and the occupational roles supporting it are so varied that developing a standardized curriculum is difficult.

“It is in the fundamentals of photonics where I think there is a shortage in the

educated workforce,” said Korthorst, whose background in microfluidics and MEMS allowed him to train as an engineer in semiconductor technology. The route he took from semiconductor manufacturing to integrated photonics provided him with the experience necessary, particularly in thin-film design, to grasp integrated photonics as its prevalence was on the rise.

“There are way more people who are able to do digital electronics, either in manufacturing or design,” Korthorst said. “But picking hundreds of them and teaching them to become experts in photonic integrated circuits? That’s also a tough nut to crack. There are fewer training programs available. There is way less training material. It becomes a burden on the companies hiring those people.”

Toward an integrated solution

Synopsys’ PIC platform supports datacom, sensors, biomedical devices, and other applications. The range of its software solutions — and, as a result, its customers — is behind the company’s keen interest in developing an integrated photonics ecosystem.

In September, the company achieved certification from AIM Photonics for its IC Validator solution for physical verification sign-off of PICs. The solution aids in the development of high-performance

networking systems on chips, AI accelerator engines, and more.

If the technician shortage in optics has imparted a lesson for the integrated photonics field, it is the importance of industry involvement in finding a mutual solution.

R&D hubs such as imec, technological research organizations such as CEA-Leti and Fraunhofer, technology platforms such as Photonics21, networks such as PhotonDelta, and industry associations such as the European Photonics Industry Consortium (EPIC) have all helped to bolster integrated photonics by cultivating

public-private partnerships, curricula development, research advancements,

recruitment, and government involvement.

Though a lack of photonics technicians is also an issue in Europe, the region has a more established integrated photonics ecosystem than the U.S. does. VLC

Photonics, a company located in Valencia, Spain, that offers PIC development services, said that it generally does not have a problem finding engineers who have the necessary skills, although filling positions for non-EU nationals sometimes requires a longer hiring process or can be more complicated. The company has not had to readjust its core job requirements or hiring criteria. For VLC engineers, required skills mainly include knowledge of PIC-specific design and layout software tools, as well as lab experience on photonics characterization and testing.

Dutch PIC packaging foundry PHIX Photonics Assembly has had to adjust

its hiring practices, though not its core hiring criteria.

“In order to attract the right talent from multiple backgrounds, we typically put in vacancies in the market with different job descriptions,” said Jeroen Duis, PHIX’s CCO. “The base backgrounds of packaging engineers and technician vary a lot. For photonics packaging, you need to know about optics, but also mechanics, electronics, physics, and automation processes.”

Globally, education is the most important element of industry support initiatives for companies and the employees that benefit from them. Unsurprisingly, education opportunities are of paramount importance to the Photonics Workforce Roadmap.

“One thing that isn’t mentioned in the report, but that has been brought up a lot with advanced manufacturing industries across the board, is the idea of industry-recognized credentialling or certification programming,” said Elizabeth Moore, a research scientist in MIT’s Materials Systems Laboratory, who worked on the Kirchain-led team to complete the report.

“In addition to updating some of

the community college curricula, if we also saw some effort to create industry-recognized credentialling programs that could cut some of that training time out on the front end, that could be very valuable.”