Compact, sensitive, and able to provide real-time location-specific data about the health of extended infrastructure, fiber optic sensors are lined up to see a new period of growth.

FAROOQ AHMED, CONTRIBUTING EDITOR

In October 2021, a 40-year-old undersea pipeline off the coast of California ruptured, releasing more than 130,000 gallons of crude oil into the Pacific Ocean. The spill polluted the ecosystem, stifled local economic activities such as fishing and tourism, and prompted renewed calls for a moratorium on offshore oil production.

The Joint Unified Command assigned to investigate the accident found that a 4000-ft section of the nearly 18-mile pipeline had recently been displaced by a distance of 105 ft — probably by a heavy anchor from a container ship traveling into the congested ports south of Los Angeles. But the date and time that the damage occurred and which ship caused

it remained unknown as of press time.

“When that anchor strike happened, if you had had a distributed acoustic sensing system in place, you would have known there was a problem, in real time, and then you could have responded to it immediately,” said David Krohn, managing partner of Light Wave Venture and the head of IEEE’s fiber optic sensor standards committee. “Not only would you have known when it happened, but where it happened along the pipeline.”

“On a 30-km pipeline — about the length of the one that just leaked in California — at 1-m resolution, you’d have 30,000 ‘microphones’ sensing ship traffic,” said Kent Wardley, chairman of the Fiber Optic Sensing Association (FOSA) and vice president of sales for the Americas at Fotech, a fiber optic sensing systems developer.

Distributed acoustic sensing is one way that fiber optic sensing systems are now being used to monitor infrastructure and detect unexpected activity in challenging environments. The U.S. Navy uses the technology as part of hydrophone systems that detect foreign submarines. Geophysicists use the sensing technology to study seismic activity and analyze distant earthquakes. And oil companies employ it to detect illegal hot tapping of pipelines.

In addition to acoustic sensing, fiber optic sensors can also monitor temperature, strain, pressure, vibration, and the relative concentration of gases and chemicals.

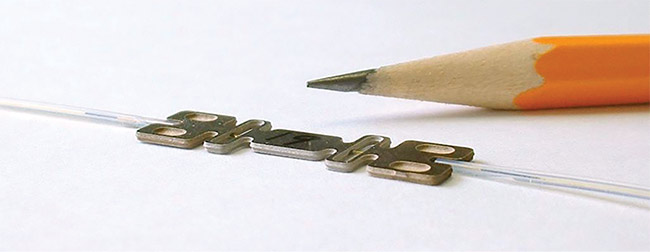

Sensors based on fiber optic Bragg gratings provide sensitive and accurate measurements of strain in a compact package, allowing ease of handling and installation. Courtesy of Luna Innovations.

Fiber sensors’ reliance on total internal reflection gives them near immunity to temperature fluctuations and electromagnetic interference. It minimizes their power consumption and allows the sensors to fit into tight spaces. The diameter of most fiber optic cables, for example, is between 0.25 and 0.5 mm.

“For every sector — from oil and gas to defense, to renewables — fiber optic sensing systems offer advantages over conventional electronic sensors,” said Alexis Mendez, principal of the consulting firm MCH Engineering. “They are very broadly applicable.”

Sensor designs

Fiber optic sensing systems send light from an LED or laser through a fiber optic cable to a detector that measures specific changes in the properties of the light. In distributed sensing, the cable itself acts as the sensing element.

External perturbations affect various properties of the light pulse, such as its intensity, wavelength, phase, or polarization state within the cable. An interrogator unit can also be designed to analyze the Raman, Brillouin, or Rayleigh backscattering of the emitted light to determine the source and location of the disturbance along a fiber cable’s length.

“You can make the optical fiber very susceptible and sensitive to external perturbations and correlate their induced changes on the light’s properties to one or more physical parameters that you’re trying to measure,” Mendez said. “By selecting the right physical effect, you can create linearly reproducible results for a given parameter of interest.” Fiber manufacturers have also manipulated the protective coating on their cables to make fibers react to specific chemicals in a way that induces a change in the optical properties of light within.

A fiber Bragg grating strain sensor is premounted on a reinforced concrete beam prior to the pouring of concrete. Upgrades to the aging transportation infrastructure in the U.S. could benefit from the inclusion of fiber sensors to monitor the health of bridges, tunnels, and other structures. Courtesy of MCH Engineering. Courtesy of MCH Engineering/Williams Inc.

Most light sources deploy light at the telecom standard wavelength of 1550 nm because this wavelength experiences low loss at long distances. But, depending on the application, shorter wavelengths, such as 850 or 1300 nm, are also used.

“The bulk of [distributed acoustic sensing] work is done at 1550 nm because you’re measuring backscattering,” Krohn said. “So, in distributed sensing, the loss in one direction will be doubled by the time the signal returns to the interrogator. At shorter wavelengths, the attenuation is going to be too high in many applications.”

While most fiber optic sensing systems use telecom-grade fiber optic cable, manufacturers have also developed cabling that incorporates fiber Bragg gratings that reflect specific wavelengths to enhance detection and provide information on multiple modalities, such as temperature and strain, at the same time. Depending on the number of fiber Bragg gratings such fiber optic sensors employ, they are often referred to as single-point or quasi-distributed systems rather than fully distributed sensing systems because

each grating acts as an individual point sensor.

Installation of fiber optic Bragg gratings designed for a preexisting oil pipeline buried along the Hood River in Washington state. Fiber optic sensors can help to monitor temperature, excess strain, and bending of pipelines caused by movement of soil around buried pipelines. Courtesy of Redondo Optics.

When paired with advanced computational techniques such as machine learning and artificial intelligence, distributed fiber sensor systems can be highly sensitive to changes in the external environment. Wardley described an application for one such solution deployed in India that can warn a utility operator when there is a potential strike to a gas line by a mechanical digger. “It can discriminate between the movement of a car or a bus on the roadway above a subsurface gas line [and] the vibrations caused by the engine of a backhoe getting ready to dig. The software is the secret sauce,” he said.

Market metrics

Despite such advancements, adoption of fiber optic sensors is progressing unevenly around the world. The size of markets can be difficult to quantify because they vary greatly, depending on the components and regions measured. Adding to the challenge is that fiber optic components are often embedded in other systems.

“There’s not great data on it,” Wardley

said. “There’s a general recognition that, particularly in the pipeline space, distrib-

uted fiber optic sensing is being used more internationally than it is in North America. There’s certainly an opportunity.”

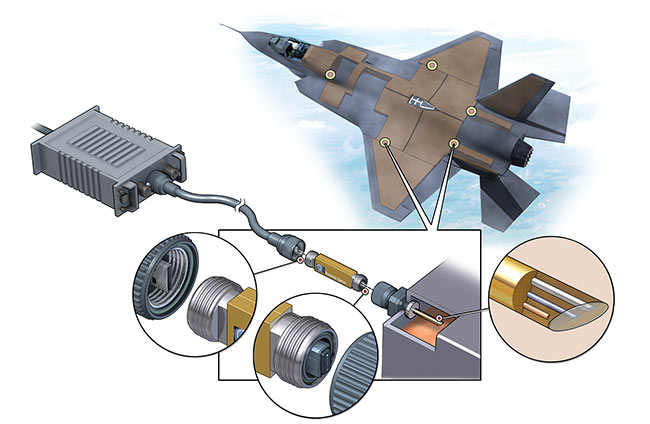

Fiber optic sensors offer a particularly appealing solution for monitoring conditions within the oxygen-saturated fuel tanks of military and commercial aircraft. The sensors’ all-optical construction eliminates the risk of electrical sparks, enables an extremely compact profile, and allows real-time data to be constantly logged.

Krohn puts the current value of the market at just under $1 billion in 2021 and projects growth to about $1.1 billion by 2026. But he includes only the hardware components and excludes installation and China. He said China is “closed” to outside fiber optic sensor technology.

An analysis of the fiber optic sensor

sector by market analyst firm BCC Research took a more optimistic view, projecting that the market would grow from $2.9 billion in 2020 to $4.9 billion by 2025.

There is a general consensus that U.S. deployments are lagging when compared to China and Europe, in particular. The reasons that most experts cite for this include cost, the complexity of deployment, and a lack of awareness of such systems.

The price of standard fiber optic cable and many types of interrogators has dropped in the past decade; however, backscatter-based interrogators are much more expensive, typically more than $100,000, Krohn said. “And, you have the installation of the cable and the system, which may be done by different companies. Then you have the software and the agency responsible for monitoring the system — there are many entities involved.”

Conversely, CEO Ed Mendoza of Redondo Optics said access to silicon photonics foundries helped to transform his business, which makes sensors based on fiber Bragg gratings. “We started out in the telecommunications market, but it was too big for us to compete in. But we were able to use the same technology for the fiber optic sensor market. Access to foundries that can produce photonic integrated circuits brought down the cost.”

Pipeline problems

The U.S. has a 2.6-million-mile pipeline network and an aging transportation infrastructure that could benefit from technologies that continuously monitor for potential faults and intrusions. Currently, much of this infrastructure is monitored by cameras and drones, and, at fixed positions, sensors — such as conventional thermometers, thermocouples, pressure sensors, and strain gauges.

“If you compare it to existing solutions, fiber optic sensor technology will be more expensive,” Mendoza said. “But depending on the cost of the structure — a new bridge or a blade for a wind turbine — you may want to be proactive to protect that level of investment.”

According to Wardley, one of the reasons that the U.S. has been slow to install fiber optic sensors at energy-related sites is that operators typically do not want to retrofit their so-called brownfield installations with the technology, which can be more challenging and therefore more costly than retaining incumbent monitoring solutions. “There’s not a lot of fiber optic cable buried around pipelines,” he said.

In many ways, the fate of distributed fiber sensors in the U.S. has followed the price of oil. While fiber optic sensing has been around in one form or another since the 1970s, it wasn’t until about 20 years ago that oil operators began using fiber optic sensors on pipelines. “In the early days of distributed sensing, the market matured backwards,” Krohn said. “It went into the toughest industry — oil — first. The environment is difficult, but the industry wasn’t too cost-sensitive.”

Now that oil prices have plunged from their peak in 2008, cost has become more of a factor for the energy sector. “All the markets for fiber optic sensors are evolving outside of energy,” Krohn added.

The IEEE standards committee that Krohn heads is one of many efforts to drive down the cost of fiber optic sensors. “If you standardize a system and design it around what the end user requires — say a civil engineer working on a bridge project — it will cost less than customized systems, which are inherently expensive,” he said.

Such standardization will allow the technology to spread beyond its current

applications. “An optical engineer doesn’t speak the same language as a civil engineer, and that can be very frustrating when adopting a new technology,” Krohn said.

Mendoza pointed out that, in contrast to Europe and China, the U.S. hasn’t had the political will to back such technological improvements to infrastructure. “If it’s going to happen here, it’ll take the fiber optic sensor companies teaming up with the infrastructure companies and heavily lobbying for smart structures with built-in sensors,” he said.

A bill before the U.S. House of Representatives could help to spur that investment. Dubbed H.R. 3684, the Infrastructure Investment and Jobs Act of 2021 has already been passed by the Senate and contains more than two dozen sections on areas, as identified by FOSA, where distributed fiber optic sensor systems could play a role. These include intrusion detection at railway crossings, investments in innovative technologies for bridge projects, integration of geolocated data on weather and roadway conditions from multiple sources, the development of smart electric grids, and improvements to make traffic systems more efficient.

“The [infrastructure] bill is an ideal opportunity to grow the adoption of fiber optic sensors and open up the market for greater demand for these systems,” MCH Engineering’s Mendez said. “And they will generate tremendous savings by giving you early warning and by reducing maintenance.”

Investment in fiber optic sensor technology could also improve safety in public infrastructure and other sectors, such as aviation. Redondo Optics’

Mendoza cited the tragic 1996 explosion

of TWA flight 800, which drove the

Federal Aviation Administration to

adopt methods to monitor oxygen conditions in the fuel tanks of commercial aircraft.

Mendoza’s company is currently testing a prototype oxygen sensor system for aircraft that is installed in the fuel tanks. “They require no electricity,” he said. “They’re all-optical and they’re small,

the size of a cigarette box. All commercial airlines operating in U.S. airspace will be required to have such systems in place by 2023.”

“I hate to say it,” Wardley said, “but it may take a few more really catastrophic accidents for continuous monitoring

systems to become mandated in the

U.S.”

He referenced the Amtrak train derailment in rural Montana in late September of last year, in which three people died and many others were injured. The cause of the derailment is unknown, but rail fatalities have risen more than 30% since 2012. “If fiber was on that track,” Wardley said, “they would have detected a bad bearing or a flat wheel or a split rail prior to the derailment ever happening.”

Acknowledgments

The author would like to thank David Krohn, Light Wave Venture; Kent Wardley, Fotech; Alexis Mendez, MCH Engineering;

Ed Mendoza, Redondo Optics; and Mark

Uncapher, FOSA.