Ever-smaller UAVs — along with larger ones built for high-altitude flight — are equipped with an impressive array of sensitive optical sensors, laser rangefinders and thermal cameras for tasks ranging from intelligence gathering to hunting down terrorists.

They’re lurking in the air in the trouble spots around the world, from the mountains of Afghanistan to the deserts of Iraq and Syria, to the disputed waters of the South China Sea. Unmanned aerial vehicles (UAVs), or drones, are acting as the eyes in the sky, playing an increasingly prominent role in spying, search and rescue operations, border security and combat operations.

Courtesy of Elbit Systems.

Today, the big players in the drone market — Boeing, Lockheed Martin, Northrop Grumman, AeroVironment, and Thales — have significantly stepped up their game, offering unmanned aerial systems (UAS) in different domains and classes. As the type and nature of drone missions has expanded, so too has the assortment of imagers, sensors and rangefinders found on them.

Advantage to the hawk-sighted

Some of the most interesting advances have come in the fast-expanding “micro UAV” class. Consider the palm-sized Black Hornet Nano drone from Prox Dynamics AS of Norway. In use by the Norwegian and British armies, the 10 × 2.5-cm system is small enough to fit in a soldier’s pocket and is deployed by throwing it in the air. Its main mission is to provide troops with situational awareness — scouting for obstacles, hidden enemy shooters and explosive traps in the war zone.

The Black Hornet drone from Prox Dynamics AS carries three cameras — including the Lepton thermal imager from Flir Systems — to help scout for obstactles and hidden combatants. Courtesy of Flir Systems.

Despite its size — it weighs less than an ounce — it can fly for up to 25 minutes at line-of-sight distances for up to a mile. Billed as an aerial sensor and hand controller, the pocket-sized system offers unique advantages for situational awareness and mission planning.

“Calling the Black Hornet a drone doesn’t do it justice,” said Kevin Tucker, Flir’s Surveillance GM. “The Black Hornet is a flying sensor, rather than a drone, as it is a highly optimized airborne vehicle that is designed to carry specific electro-optical sensors.”

The Black Hornet features three cameras in all, including Flir Systems’ Lepton microthermal camera and a visible spectrum camera, as well as a low-power rotor and software for flight control, stabilization and communications.

“Prox Dynamics was actually one of our first customers for Lepton on their Black Hornet,” said Jeff Frank, senior vice president at Flir, which acquired Prox Dynamics in November. “Through Flir’s unique, commercially developed, military-qualified (CDMQ) business model, we invest in our own research and development, which enables us to build products and bring them to market faster. We’re continuing to invest to reduce the size, weight and costs of our sensors.”

Smaller than a dime and less expensive than a traditional IR camera, the Lepton was first introduced to bring thermal imaging to smartphones. It captures highly accurate, calibrated temperature from a distance, and features a radiometric thermal camera core, meaning it measures the absolute temperature in a scene.

While the company didn’t disclose the specific use cases of the Lepton in a military setting, Frank noted that Flir also offers a commercially available radiometric IR camera — the Vue Pro R series. Knowing the absolute temperature of, say, an insulator in a power grid can be a strong indicator of the likelihood of a pending failure, Frank said.

For thermal cameras like the Lepton, there have been notable gains in heat dissipation. Ultra-light cryocoolers help reduce the sensor temperature to cryogenic temperatures, which boosts target detection and surveillance capabilities.

“The increasing concern over developing cost-effective cooling technologies is widening the opportunities for the cooled thermal imaging camera providers,” said Moutushi Saha, lead analyst at Technavio, a market research firm that recently published the report “Global UAV Payload and Subsystems Market 2017-2021.”

Size, weight and power

With the proliferation of mini drones comes a greater emphasis on sensor components that are smaller and more rugged — and often times available off the shelf.

In pint-sized UAVs, “the size, weight, power and cost (SWaP-c) parameters can be very critical and require the embedded systems to meet strict design and weight constraints,” Saha said.

Those factors are often part of the conversation, confirmed Eric Desfonds, product line manager of sensors for the defense and aerospace division of Excelitas Technologies, which supplies photodiodes and lasers used in optical systems aboard defense UAVs, notably in laser rangefinders and laser spot trackers.

“In line with the desire to continue to optimize SWaP-c, we make small but high-performance components that are the building blocks for more complex systems,” said Desfonds. “There is a desire in the market to use smaller packaging, even SMD [surface-mount device], not necessarily for UAVs, but in general for military systems. The commoditization of avalanche photodiodes and pulsed laser diodes certainly explains this.”

The level of customization for components required in UAV payloads can vary considerably, but the assessment usually begins with what’s already available on the market.

“Commercial off-the-shelf (COTS) products are often considered by designers. We sample first our COTS offerings and provide customizations and/or qualification to meet the customer’s unique needs,” Desfonds said. “Component design can be optimized to meet specific standards for the UAV design.”

After that, components may be optimized for the respective UAV design.

“The rapid designing and innovations in COTS-based technologies have enhanced the computing capability and enabled compact designing,” Technavio’s Saha said. The “reduction of complete system development costs and reduced long-term maintenance costs have also driven the employment of COTS components.”

A UAV equipped with an inbuilt camera and sensor processing unit, for example, has elements for imaging processing, image stabilization, video compression, analysis and tracking.

“All of these functions can be achieved just by employing an advanced COTS module, which is as compact as an SD memory card and can be used in the smallest sensor platforms,” Saha said.

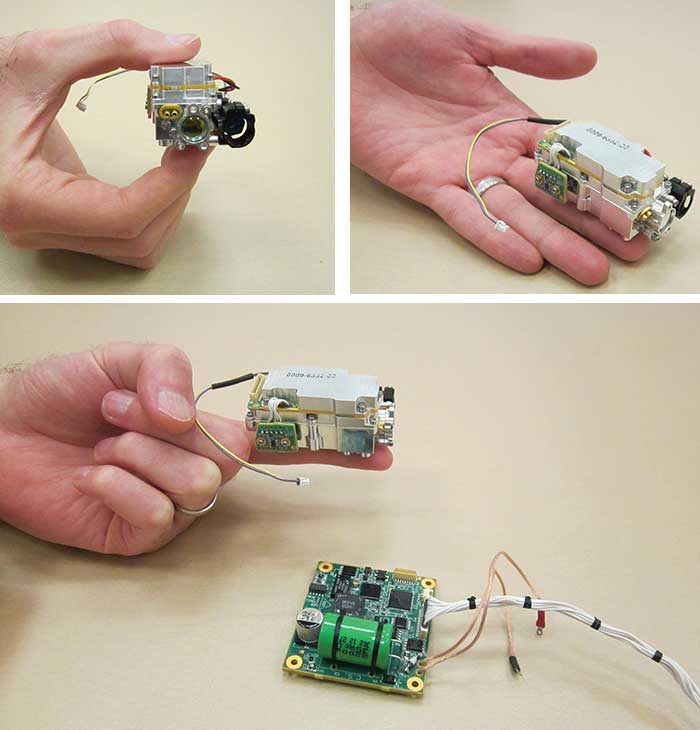

Another good example of the miniaturization trend can be found in an innovation from Haifa, Israel-based Elbit Systems. The company developed a new type of miniature designator marker (MDM) for its small-class UAVs. Laser designators allow users to rapidly home in on hostile targets.

A close look at micro designator marker (MDM), the miniature designator from Elbit Systems. Courtesy of Elbit Systems

“The operational need to designate from small UAVs, particularly below cloud cover, has become an ever-growing requirement to enable significantly shortening the sensor-to-shooter duration,” said Dalia Rosen, Elbit’s VP of corporate communications.

Elbit’s high-performance MDM weighs only 100 g and is assembled using automated robotic techniques; it’s too small to be manufactured using standard methods, according to Rosen.

The mini drone is developed for rapid deployment and can be carried and operated by two operators. Courtesy of Elbit Systems.

It fits within the 4-in.-diameter optical turret aboard Elbit’s Skylark mini-UAV that weighs only 7.5 kg. The Skylark can be used in conjunction with a fighter aircraft capable of deploying laser-guided weapons.

UAVs flying higher

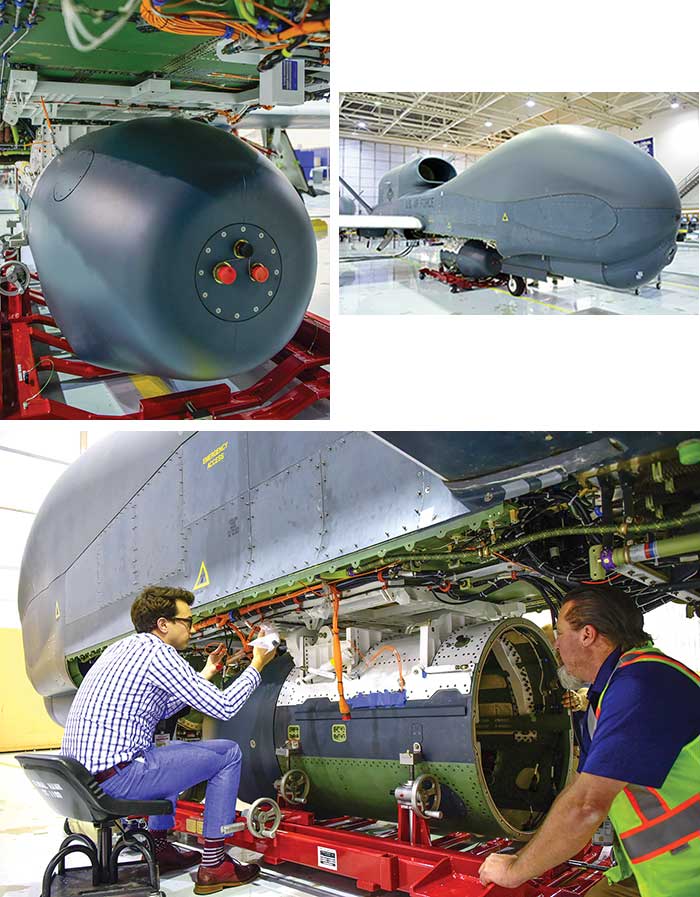

On the other end of the spectrum from the hand-launched Skylark and micro-sized Black Hornet is the granddaddy of unmanned combat aircraft, Northrop Grumman’s Global Hawk. With its 130.9-ft wingspan, bulging front and elegant looks, it dwarfs other entries in the UAV defense sector.

Scenes from the recent sensor installation of the Global Hawk. Courtesy of Photographer Alan Radecki Northrop Grumman.

In operation with the U.S. Air Force since 2001, Global Hawk has amassed more than 200,000 flight hours with missions flown in support of U.S. military operations in Iraq, Afghanistan, North Africa and the greater Asia-Pacific region. It flies at very high altitudes — up to 60,000 ft — and for up to 30 hours at a time.

Its multiple sensor payloads gather near-real-time, high-resolution imagery of large areas day or night, not only “finding” targets using broad area searchers, but also fixing, tracking and assessing targets through its multiple sensor modalities.

Currently, it’s undergoing an upgrade to the MS-177 seven-band multispectral sensor developed by UTC Aerospace Systems. The enhancements include a gimbaled optical design, a wide-area search mode and a motion imagery mode, according to Northrop Grumman. This upgrade essentially gives Global Hawk the ability to collect more than six times the area coverage in an hour than the current SYERS-2B operating on the U2 platform. The MS-177 can continuously track a target without having to change the UAV’s flight path.

The MS-177, according to the research firm MarketsandMarkets, now “has the ability to provide the longest-range combat identification imaging capability in the U.S. military’s inventory.”

Flight tests with the new seven-band multispectral sensors began earlier this year, a Northrop Grumman spokesperson said.

In October of last year, the company tested a second sensor designed specifically for the requirements of high-altitude long-endurance missions. An optical bar camera synoptic sensor was fitted to the turret of a RQ-4 Global Hawk UAV.

“The high-altitude optical bar camera is the world’s highest-resolution broad-area synoptic sensor,” said Sachin Garg, an associate director at MarketsandMarkets and co-author of a recent report on the UAV defense market, “Drones Market by Type, Payload, Application, Component and Geography — Global Forecast to 2022.”

The Global Hawk also tested the SYERS-2 intelligence-gathering system last February. The SYERS-2 features shortwave- and midwave-IR capabilities for low light operation and is capable of penetrating haze and smoke, making it particularly useful in detecting counter-insurgency operations.

Operating in low light conditions was a key attribute behind the development of the Mantis i45 gimbal, designed to deliver lightweight, compact and powerful visual awareness to the Puma AE unmanned aircraft from AeroVironment.

AeroVironment’s Puma AE is equipped for land and maritime operations. Its gimbaled payload (inset) includes a stabilized IR camera and IR illuminator in one modular payload. Courtesy of AeroVironment.

The gimbal features a suite of sensors for daylight, low light and thermal imaging including ultra-high-resolution electro-optical and IR imagers. The thermal IR imagers feature resolution of 640 × 512 pixels and a field of view at 32°. Dual 15 megapixel color cameras are designed to offer wide and narrow views.

Fully waterproof, the gimbal provides full lower hemisphere coverage, continuous pan and is packaged to withstand extreme environments.

“The combination of sensors and how they’re packaged is unique to us,” said Steve Gitlin, vice president of corporate strategy for AeroVironment, a supplier of UAVs to virtually every branch of the U.S. military and to 35 allied countries. “The fact the Puma can land on the ocean is a unique breakthrough in the space,” he said.

The Puma was used last year aboard the U.S. Coast Guard Cutter Polar Star as part of an expedition to open up sea lanes in Antarctica. That mission involved streaming real-time footage from the i45 gimbal high-resolution and IR cameras to better understand ice thickness and other conditions.

Vidar: a new technology for maritime monitoring

Another major player in the UAV field is Boeing, which, along with its subsidiary Insitu, offers UAVs of varying sizes and payloads for customers throughout the global defense markets.

“Our defense customers are increasingly employing us to provide them with high-resolution video imagery correlated with other types of sensors to achieve situational awareness and clarity,” said Dave Anderson, director of defense payloads for Insitu.

Those sensors include an electro-optical imager, a midwave-IR imager and laser rangefinder, all housed aboard Insitu’s RQ-21A Blackjack, an unmanned system used extensively by the U.S. Marine Corp.

The Blackjack has two siblings: the slightly smaller ScanEagle, and the 135-lb Integrator. Featuring a 16-ft wingspan, the Integrator’s payload includes a laser rangefinder, IR marker and high-definition electro-optical imager.

“Both the ScanEagle and Integrator are built in modular fashion, so we have the ability to change between payloads in the field,” said Anderson. “This allows us to swap between our high-resolution EO900 turret to our EO/MWIR/laser pointer ‘dual imager.’”

The increasing need to monitor the world’s oceans from above prompted Insitu to unveil vidar (visual detection and ranging) technology aboard the ScanEagle in 2016. A wide-area autonomous detection system for electro-optic imagery, the vidar system includes a large backplane digital video camera that continuously scans the ocean in a 180° arc in front of the vehicle. Software then autonomously detects any object on the surface of the ocean, and it’s so sensitive, it could detect the spout of a whale at

1.5 nm from the air.

“The original mission for our UAS was to search the ocean, initially for tuna, but not that much later for objects of more military interest,” Anderson said. “As we evolved our full-motion video capability, we were stretched by two competing objectives — wide-area search and discovery and high-resolution imagery of objects in the water.”

Working with the software company Sentient Vision Systems (SVS), Insitu employed a proprietary processing capability to find objects in the incoming video. The success of pixel-based search is directly related to the number of pixels available.

“The dual turret capability of vidar is the answer,” he said. “While the multi-megapixel camera in the aft turret step-stares across a 180-degree swath, providing food for the SVS algorithms, our EO zoom camera up front allows us to interrogate the objects that the aft turret finds.”

That combination proved highly effective for improving situational awareness in trials in the Pacific Ocean, off Cape Cod in the Atlantic, and during the Unmanned Warrior exercise in Scotland last year, he said.

Lockheed Martin also has its eyes on the high seas. Last summer it deployed a canister-launched small drone from an autonomous underwater vehicle in naval exercises held in Narragansett Bay, R.I.

Following instructions from a ground station via underwater communications, the underwater vehicle successfully launched the 4-lb Vector Hawk, which in turn transmitted continuous video during its flight from its Perceptor dual-sensor gimbal, a payload that included both electro-optical and IR imagers, as well as a laser illuminator.

The Perceptor is integrated into Procerus Technologies’ vision processing unit, for target tracking, target geolocalization and net landing capabilities.

Future tradeoffs

One of the biggest challenges right now is addressing customers’ demand for higher resolution and increased endurance — even as UAVs become smaller.

“There are always trade-offs in the space in which we operate,” said Aero-Vironment’s Gitlin. “Any increase in battery size means we’re carrying a heavier payload, which can adversely affect other system attributes such as flight time. At the same time, we’re seeing innovations occur at the nanoscale.”

Unmanned Black Hawk Relies on Single-Photon Lidar for Navigation

Last year, Sikorsky, a subsidiary of Lockheed Martin, in partnership with Carnegie Mellon University and United Technologies, conducted a joint autonomy demonstration involving both an unmanned ground vehicle and a UH-60MU Black Hawk.

The Black Hawk was equipped with Sikorsky’s Matrix technology — a set of hardware and software capabilities for autonomous flight — and was used to transport an autonomous unmanned ground vehicle to its mission area 12 miles away. The proof-of-concept demonstration was intended to showcase how autonomous technology can prevent exposing warfighters to hazardous conditions.

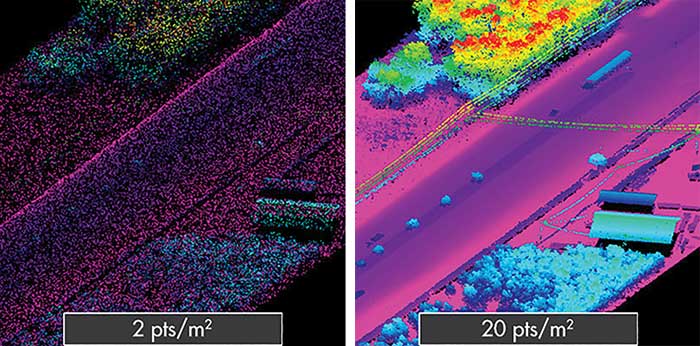

Geiger-mode lidar offers 10 times the resolution at four times the altitude compared with linear-mode lidar. Courtesy of Princeton LightWave.

Aboard the Black Hawk was a single-photon lidar system featuring unprecedented sensitivity.

“Our ‘secret sauce’ is a single-photon technique called Geiger-mode lidar,” said Princeton Lightwave’s Jay Liebowitz, whose company developed the free-running camera.

Single-photon or Geiger-mode lidar differs from conventional lidar in the very high rate of eye-safe laser pulses emitted (usually at 1.5 or 1.06 µm from YAG lasers). A Geiger-mode camera can count the small percentage of photons that bypass water droplets in the air, to get a true picture of what’s in the flight path.V

“The value in what we do is seeing through obscurants such as rain, fog and snow,” Liebowitz said, a capability that’s also prized in the advance of driverless cars.

Princeton’s Geiger-mode camera features a 32 × 32-pixel focal plane array. It also features a “free-running” capability, allowing the camera to detect and read out events simultaneously — critical for applications such as coherent lidar and ultra-sensitive lidar situational awareness.

UAV Payload Market Set to Eclipse $10.5 Billion

The U.S., Russia, China and the U.K. have all made significant investments in developing next-generation UAV platforms for strengthening their security and surveillance offerings. The increasing need for surveillance and security operations, along with growing territorial disputes in maritime regions, has pushed military agencies to invest more in enhancing their target acquisition capabilities and acquiring more advanced UAVs with associated payloads and subsystems, according to Technavio, which recently released its “Global UAV Payload and Subsystems Market 2017-2021” report.

The Global Hawk in flight. Courtesy of Northrop Grumman.

The firm estimates that the global UAV payload and subsystems market will reach a compound annual growth rate (CAGR) of 7.72 percent over a five-year period, reaching $10.05 billion in 2021 from $6.93 billion in 2016. In terms of regional segmentation, North and South America held a 49.21 percent market share in 2016, followed by APAC at 30.16 percent and EMEA at 20.63 percent.

The cameras and sensors segment constituted the highest share of the UAV component market at 39.97 percent in 2016, followed by the weaponry segment, which had a share of 27.27 percent.

Lockheed Martin’s Vector UAV in flight. Last year, the Vector was canister-launched from the unmanned Martin submarine. Courtesy of Lockheed Martin.