Today’s machine vision products offer better performance at lower cost.

John Merva, Automated Imaging Association and CCS America, and Paul Kellett, Automated Imaging Association

More than 25 years after machine vision appeared in the industrial automation marketplace, the technology has established itself as a necessary part of high-quality, cost-effective manufacturing. Over the past decade, the capabilities promised from the beginning have been realized. We are now in the phase where users will reap more and more performance benefits at lower cost.

Machine vision is used in virtually every manufacturing-dependent market, from food and pharmaceuticals to automotive and general manufacturing to semiconductor and nanotechnology. The technology is diverse, drawing from semiconductor, electronics, control, packaging, and optics and illumination technologies to create vision solutions.

In the global machine vision market, we see the following trends:

• Declining prices

• Expanded capability

• Miniaturization

• Increased integration

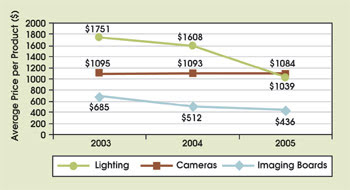

Declining prices means that machine vision technology has become generally more affordable (Figure 1). These decreases are largely the result of increased competition in the market and are further supported by technological developments in the industries that supply components to machine vision applications.

Figure 1. Declining product prices have made machine vision increasingly more affordable. The data for all figures are from the Automated Imaging Association.

Greater capability is largely a result of increased computing power, sensors with higher resolution and faster scan rates, and more capable software (Figure 2). This is one area where machine vision has been able to ride the coattails of developments in the computer and communications industries. PC processor speeds have steadily increased while prices have fallen, driving the development of faster buses, which in turn allow larger images with more data to be moved and processed more quickly.

Figure 2. A number of technological changes have contributed to the trend of increased capability.

Phones and PDAs have driven the development of faster, less-expensive reduced instruction set computer (RISC) processors (such as XScale from Intel), enabling smart cameras and embedded processors. Likewise, developments in field-programmable gate arrays (FPGAs) are adding computing power to smart cameras, embedded processors and high-performance frame grabbers for PCs. Finally, consumer-grade digital cameras have become ubiquitous, and high-end, machine-vision-grade sensor development efforts have certainly benefited.

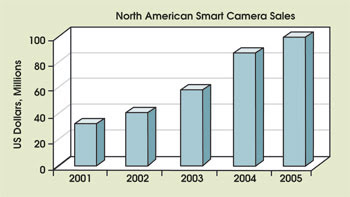

Figure 3. Miniaturization has enabled the development of the smart camera, which has experienced a dramatic growth in sales in recent years.

Miniaturization has enabled the industry to pack more components into a smaller space. This means that machine vision products have smaller form factors, so they fit into the limited available space on factory-floor machinery.

The growth of smart cameras illustrates the trend toward integration. While many vision systems remain highly modular — comprising components that are combined specifically for a particular task — smart cameras integrate the processor, lens, lighting, input/output and Ethernet into a single package. Miniaturization and integration are working together to achieve the ultimate goal — a vision system on a single chip.

LEDs for vision

A number of trends have developed at the component level in the industry. For example, LEDs have become the predominant light source. Their small size facilitates a multitude of geometries, and their durability and stability are well suited for factory applications. High-output LED light engines first appeared on the scene about five years ago. Now new manufacturers are entering the high-power light-engine market with brighter, more efficient sources. Machine vision lighting suppliers are taking advantage of these components, creating light designs for the ever-growing number of applications.

UV, IR and color-adjustable light sources are further expanding the range of applications for LEDs. Although optical fibers are being used less, they are still valuable in many applications. Digital and closed-loop control of lighting also are becoming generally utilized. Look for manufacturers to begin offering Ethernet-based control as that technology becomes the communication method of choice on the factory floor.

The move from analog to digital is prevalent in the camera market. Camera Link, USB and IEEE-1394 came first, and Gigabit Ethernet is rolling out. Digital interfaces have become necessary as sensor resolution and frame and scan rates have risen. CMOS and CCD sensors both have benefited from improvements in overall performance and increased market penetration.

A significant trend in digital cameras is that FPGAs and other processors are required to facilitate data transmission. These devices can be used to perform image preprocessing tasks that previously were carried out by the primary vision processor or frame grabber. This frees up the primary processor significantly and blurs the line between cameras and smart cameras. This trend will continue, with many variations existing between sensors and fully capable smart cameras.

The frame grabber market is particularly affected by the move to digital camera interfaces. While the increasing need for very high performance is stimulating demand for Camera Link-based frame grabbers, lower-end digital interfaces require no frame grabber at all.

Faster PC buses such as PCI Express are allowing a new generation of high-performance frame grabbers. These high-end boards increasingly are using digital signal processors, FPGAs and other hardware to do more image processing onboard, thereby relieving the CPU of these chores.

As the high-end frame grabber with full Camera Link moves toward becoming the primary interface, look for specialty frame grabbers based on Gigabit Ethernet to become prevalent as well. These are network interface cards that allow the host processor to offload image loading and memory transfer tasks.

Smart cameras flourish

Industrywide, smart cameras continue to be the most dynamic devices, with continual improvements being made to processing capability. More powerful processors and software algorithms are enabling this class of machine vision system to satisfy more complex applications. Smaller and denser memory, increased imager resolution and CMOS sensors are aiding the development and proliferation of smart cameras.

Look for advances in processors and sensors combined with greater market competition and falling prices as performance and capability continue to grow. PC-based systems also are benefiting from this trend.

Most basic image processing algorithms have been around for some time, but newer, higher-level tools (made up of a sequence of lower-level steps) are adding significant capability to all machine vision systems. This is particularly evident in vertical markets, where the same or similar applications can be replicated across many customers. These higher-level tools are present in code-based programming environments as well as in graphical user interface environments.

One of the more exciting developments is the entry of high-level, graphical environments into the FPGA area. While many frame grabbers and smart cameras use these arrays to accelerate parallel operations, their programming has been restricted to product developers. Recent product announcements are bringing high-level tools to users so that they, too, can take full advantage of the power of FPGAs. These high-level tools — combined with the proliferation of FPGAs in cameras and smart cameras — will further expand capabilities in these components.

As a consequence of these trends, it is clear that although machine vision products are increasingly enabling efficient, high-quality production, they also are becoming less expensive on average. In effect, purchasers of this equipment and software have been receiving better performance for less money, making machine vision more and more of a wise purchase and even indispensable to manufacturers. For all these reasons, we can only expect machine vision use to continue to expand.

Meet the authors

John Merva is president of the Automated Imaging Association (AIA) of Ann Arbor, Mich., and vice president of sales and marketing for CCS America of Waltham, Mass.; e-mail: [email protected].

Paul Kellett is director of market analysis for AIA; e-mail: [email protected].