MICHAEL EISENSTEIN, SCIENCE WRITER

The dream of fully autonomous, driverless cars remains just that for now — a vision of a future that will require considerable effort from engineers and programmers to realize. But other, subtler forms of automation are already entering the market for both passenger and commercial vehicles, in the form of advanced driver-assistance systems (ADASs). And parallel advancements in sensors based on light detection and ranging (lidar) are helping to pave the way.

Lidar is essentially the optical equivalent of radar. Light is projected from a laser source, and the reflected illumination is captured and analyzed by a detector to generate a map of objects in the sensor’s field of view. The technology is more than 60 years old and has been used for decades in applications such as topographical mapping. But it was only with the first forays into self-driving autonomous vehicles — most notably the DARPA Grand Challenge — that automotive applications for lidar sensing began to gain momentum. For example, Stanford University’s Stanley autonomous vehicle, which was armed with five lidar sensors made by Sick AG, achieved the first-ever victory in DARPA’s 2005 contest.

The predicted surge in automotive lidar systems has been stalled by high costs and other factors. But the technology is gaining momentum with the emergence of more compact and robust systems that are able to efficiently capture comprehensive and accurate data more quickly. Courtesy of Luminar.

While cameras can serve as an analog for the human eye, they also share many of its limitations and can fall short in the same conditions in which humans struggle to see. This is a major impediment for ADAS technology, which is intended to support vehicular safety by alerting drivers when they stray from their lanes, for example, or by promptly triggering the braking system if an obstacle is detected in the road.

“Since lidar uses active illumination, the sensor performance is very uniform in full-sunlight or nighttime conditions,” said Matt Weed, senior director of product management at Luminar Technologies. Lidar data can also be computed more rapidly than video data, he said, which helps ADAS technology to make snap decisions at highway speeds, even at night or in poor weather or on tight curves.

As automotive lidar becomes more capable of spotting obstacles in a driver's path, it faces fewer obstacles on the road to broader adoption.

Market analysts have anticipated a surge in automotive lidar for some time, but that surge has been delayed by high costs and an initial generation of ADAS technology that was relatively primitive. But things are changing quickly.

“The growth that we had forecast is happening now,” said Alexis Debray, technology and market analyst at Yole Développement. “We expect the lidar market will double in the next five years, and this is mainly due to ADAS applications.” Indeed, Yole predicts ADAS applications will fuel a $2.3 billion global market for lidar by 2026.

Although only a handful of vehicles are currently equipped with such sensors, this situation is due to change within the next few years, as virtually every major auto manufacturer is now making a play for the ADAS space. “If we’re talking to

[automotive] OEMs today, it’s usually about a program that scales in 2024 or 2025,” said Laura Wrisley, vice president of sales at Velodyne.

Mechanical scanning lidar systems are comparatively inexpensive and offer long detection ranges in multiple directions. But many of these systems tend to be bulky and perform better when situated higher on the vehicle, which can compromise the sleek automotive profile that appeals to many consumers. Courtesy of Velodyne.

Even the experts are startled by how quickly the lidar manufacturing space has grown, with more than 80 companies, ranging from established players such as Luminar and Velodyne to a plethora of newly formed startups and spinoffs.

“It’s amazing how many different

approaches there are,” said Pierre Olivier,

CTO of LeddarTech. “Some are slight permutations on somebody else’s

approaches, but some of them are very unique and new.”

The question becomes: Which technology or combination of approaches will ultimately usher in the new era of ADAS-enabled vehicles?

Scanning the horizon

The mapping strategy employed by most current lidar systems uses time-of-flight (TOF) imaging, in which the relative proximity of an object is determined by how quickly the detector receives photons reflected from its surface.

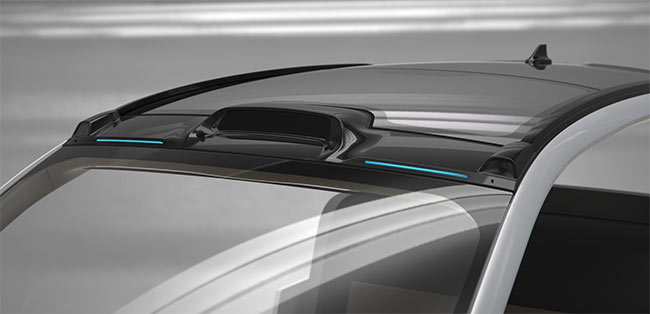

MEMS technology is helping to scale down the bulkiness of conventional mechanical scanning systems, allowing for more compact lidar systems that can integrate more seamlessly into a vehicle’s visual profile. Courtesy of Luminar.

One of the underlying limitations of TOF is that a single laser or even a small array of lasers will generate data within a limited field of view. So, a scanning mechanism is required in order to generate a three-dimensional point cloud that depicts the road, pedestrians, and other environmental features along the route of a vehicle.

The first wave of automotive lidar systems to reach the market used mechanical scanning systems to achieve this coverage. Velodyne, the first company to launch a commercial automotive sensor, uses a rotating mechanism to spin its

detector system and thereby produce a 360° view at distances up to 300 m.

Alternatively, Luminar uses a galvanometric system to shift mirrors that rapidly scan a static beam both horizontally and vertically. According to Weed, the system can achieve detection at ranges of up to 600 m, although the primary aim is to capture details closer to the vehicle. “The goal is to be able to understand everything that’s happening within a 200-m range and measuring the road surface at about 75 to 100 m,” he said.

Flash lidar employs solid-state technology that spreads out the laser beam to illuminate an entire scene in a single burst. It blends seamlessly into an automotive profile, and it is durable against both shock and vibration. But the technology is potentially vulnerable to background noise because it requires using more sensitive detectors to capture the smaller number of reflected photons relative to mechanical scanning systems. Courtesy of Ouster.

Mechanical scanning systems have a proven track record, and many car companies have opted to play it safe with this approach in their early ADAS designs. Velodyne, for example, has formed partnerships with Ford, Baidu, and Hyundai, while Luminar is working with Daimler and Volvo.

It’s the most widely available technology, said Wrisley. “It’s inexpensive, and it offers the best balance of overall system complexity and performance in terms of range and resolution.” She also challenged concerns about the durability of the systems by pointing out that Velodyne has found the life expectancy of rotational-scanning lidar systems to be comparable to that of the vehicles to which they are coupled.

Mechanical scanning systems tend to be bulky, however. And, because their sensors generally perform better when situated higher on the vehicle, it can be challenging to seamlessly integrate mechanical scanning lidar into a car’s design.

“If it’s a robotaxi, perhaps you don’t mind so much that you have a rotating-

architecture system on top of it,” said Denis Boudreau, product leader for high-performance sensors at Excelitas Technologies. “But when you get into consumer cars, aesthetics are extremely important, and a lot of people buy cars based on how they look.”

The bulky architecture of these systems can be scaled down through the use of micro-electromechanical systems (MEMS) that, technically, also employ mechanical scanning of the laser beam. The difference is that MEMS do this by using mirrors that are millimeters in scale. These systems are more compact and thus easier to integrate into a vehicle’s visual profile.

While MEMS are a well-established technology, Weed said these systems may also be more susceptible to variable performance from extreme temperatures, mechanical shock, and/or vibration than their larger counterparts.

Nevertheless, MEMS lidar technology is also making its way into the market. BMW, for example, is using MEMS-based systems from Israel-based Innoviz in its autonomous vehicle initiatives.

A solid alternative

Many observers of the automotive lidar market see mechanical scanning systems as a transitional technology that’s paving the way for more robust solid-state systems currently in development. According to Olivier, longer-term demand for solid-state lidar is very strong. “But industry is focused on performance first and then solid-state design second,” he said.

The potential advantages are clear, Boudreau said. “When you have more moving parts, there’s more chances for failure.”

Richard Shannon, a senior analyst at Craig-Hallum, said that solid-state is likely to acquire an edge over mechanical scanning once it establishes a clear track record of reliability and performance. “Once that gets worked out, that certainly sets a timeframe for the endpoint of rotational or mechanical lidar, simply because those systems are too big, too power hungry, and too costly,” he said. Even companies that have built a reputation for mechanical technologies are actively conducting research and development into solid-state alternatives.

The use of VCSEL arrays and single-photon avalanche diodes enables flash lidar designs with extremely compact form factors. Courtesy of Ouster.

Flash lidar is currently by far the most advanced solid-state technology. In these systems, the laser beam is spread out to illuminate an entire scene in a single burst, analogous to a camera flash, and the reflected signal is then collected and analyzed by detectors to generate a complete 3D scene. The approach is fast and durable against shock and vibration, but it is vulnerable to confounding background noise because it requires more sensitive detectors to capture the smaller number of reflected photons relative to mechanical scanning systems.

Early adopters of flash technology, such as LeddarTech, have made headway on this front, demonstrating that they could achieve 200-m detection ranges on low-reflectivity targets, Olivier said.

The company is also addressing flash lidar’s noise problem by using improved signal acquisition and processing capabilities. Meanwhile, a company called Ouster has tackled this problem using a different approach. Its systems illuminate a scene more efficiently with each burst by employing arrays of vertical-cavity surface-emitting lasers (VCSELs). These highly compact sources project perpendicularly to the die rather than laterally like conventional edge-emitting lasers do. Ouster has coupled these VCSELS with arrays of ultrasensitive single-photon avalanche diodes (SPADs) to achieve highly efficient detection. This approach could yield solid-state systems with an extremely compact form factor. “You could probably integrate that into a few chips, and, over time, you might be able to get it down to something approaching the size of a pack of cards,” Craig-Hallum’s Shannon said.

Companies are also exploring other refinements on the laser front, including longer-wavelength beams. The industry standard wavelength for lidar is 905 nm, based on legacy diode technology developed for the telecommunications industry, which favored the wavelength because of the excellent response it elicits from silicon-based detectors. But this wavelength can also be damaging to the human eye, limiting how much output power the laser can safely emit and, therefore, how much range and resolution a lidar system can achieve.

Beams that venture into the near-infrared are much safer, even when pumped out at high energy levels. Luminar is one of several companies making use of 1550-nm diode lasers as an alternative. Selecting NIR wavelengths is important for achieving longer detection ranges, and autonomous vehicles need to understand what’s happening farther away to be able to react to things at high speeds, Weed said. NIR diode lasers are much more expensive than 905-nm sources and require costly specialized

detectors based on indium gallium

arsenide (InGaAs) rather than silicon.

Long wavelengths also encounter greater absorption from water, which is a potential problem for lidar systems operating in adverse weather conditions. But Weed argues that the increased laser power that can be safely generated at

1550 nm overcomes this challenge.

NIR diode lasers are also an important building block for an emerging alternative to TOF-based lidar known as frequency-modulated continuous-wave (FMCW) lidar. These systems use tunable lasers that continuously project a beam while incrementally shifting the frequency of illumination. By analyzing the frequency of the reflected signals, FMCW lidar systems can not only determine the presence of obstacles with the range advantages conferred by 1550-nm lasers but they can also calculate the speed at which those objects are moving relative to the vehicle.

More than a dozen companies are actively focused on developing FMCW lidar technology. One early mover, Aeva Technologies, has claimed detection ranges of up to 500 m with its platform and is currently partnering with Porsche as well as auto parts maker DENSO. “We expect FMCW to be ready to enter the automotive market around 2025,” Yole’s Debray said. “It’s going in a good direction.”

Moving into the market

Since virtually every new automotive component needs to be certified for use in cars and trucks, change comes slowly in the vehicular world. Boudreau said automotive-grade requirements are often more stringent than those for aerospace applications. This means that mechanical-scanning-based systems — whether they be macroscale or MEMS — are likely to remain the dominant technology for at least the next five to 10 years, although the industry may still generate some surprises.

For example, General Motors (GM) recently announced that its new Ultra Cruise hands-free driving system will

be deployed in consumer vehicles by 2023. GM’s system is based on an unusual scanning technology developed by Cepton Technologies, which applies a microscale beam-scanning approach based on acoustics rather than MEMS mirrors. This reduces the complexity of the beam-scanning system and the potential for

mechanical failure or disruption by environmental conditions. Shannon believes that GM’s move could be the first shot across the bow signaling broad adoption of lidar technology for ADAS.

Cost will be a critical determinant as to which companies and technologies ultimately prevail. “Systems today are probably on the order of thousands of dollars, and it needs to get down into the hundreds of dollars to be fully deployable in cars that are relatively affordable,” Boudreau said.

Early deployments of lidar have generally been in high-end luxury vehicles and commercial vehicles such as tractor trailers or robotaxis, which generate revenue that could potentially absorb the cost of such systems. But as demand goes up and the capacity for mass production increases, costs could rapidly fall to a level that would appeal to more mainstream automotive customers. The rapidly growing appetite for lidar sensing in other applications such as industrial automation and smart cities could also help to fuel

the trend toward mass production.

Although consolidation of the crowded lidar market seems to be inevitable, there is ample room for multiple-sensor

designs. Most market observers believe

that the future of ADAS and fully autonomous vehicles will come down to multimodal detection. This could mean vehicles will incorporate multiple different lidar systems that perform distinct functions. A single vehicle, for example, may benefit from short-range lidar

systems that monitor the sides of the vehicle, as well as longer-range lidar for frontal detection.

“Ultimately, you want solutions that

are going to be robust in all conditions,” Olivier said. “And we feel very strongly that the best and the most prudent

approach is to leverage all modalities

and getting the best performance through this fusion.”